MercoPress. South Atlantic News Agency

Argentina's YPF planning to cut capital expenditure by at least 20/25%

“We do not see a meaningful production growth this year,” Chief Executive Officer Miguel Galuccio told an investor conference call.

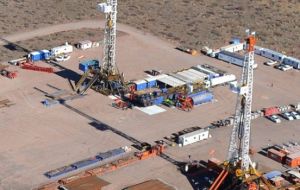

“We do not see a meaningful production growth this year,” Chief Executive Officer Miguel Galuccio told an investor conference call.  YPF said 20 rigs had been put into standby by December and that the number of rigs now operating in Vaca Muerta stood at 11 from 17 last year.

YPF said 20 rigs had been put into standby by December and that the number of rigs now operating in Vaca Muerta stood at 11 from 17 last year. Argentina's state-controlled energy company YPF will cut capital expenditure by at least 20-25% this year to mitigate the impact of the global oil price rout — leading to growing concerns among union leaders, who claim up to 2,000 workers would be laid off because of the company’s decision.

In a clear acknowledgement that the global downturn was hurting the exploration of one of the world’s largest untapped shale resources in Argentina, YPF said it was putting rigs into standby mode and forecast tough discussions with labor unions.

“We do not see a meaningful production growth this year,” Chief Executive Officer Miguel Galuccio told an investor conference call. Asked if the reduction in investments could be more severe, Galuccio said: “20% is a starting point. If we need to go down further, we will.”

Galuccio’s chief financial officer, Daniel Gonzalez, said Argentina’s largest petroleum producer was considering a single bond issuance on international markets this year but added there was no clarity on timing. He did not say how much would be issued.

A depreciating Argentine peso currency and cut in the government-fixed price of domestically-produced oil helped YPF into the red in the fourth quarter, with the company posting a 1.70 billion-peso loss.

Galuccio forecast the local price for crude oil, set artificially high at US$67.50 per barrel, would hold steady in the near future. Even so, he said the low international oil price would require a reduction in exploration activity and “more effort on the cost side” from YPF.

YPF said 20 rigs had been put into standby by December and that the number of rigs now operating in Vaca Muerta stood at 11 from 17 last year.

The executives acknowledged that “difficult” labor talks loomed. “We are discussing with the unions the way we can handle this without having a major impact on the workers,” said Galuccio.

Covering an area the size of Belgium, Vaca Muerta was a geologically more complex shale resource than most US fields but was becoming better understood, Galuccio said. He anticipated the cost of drilling horizontal wells in Vaca Muerta would fall to US$10 million per well this year from US$13 million last year.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsGaluccio’s ALIVE! (sorry Flash).

Mar 07th, 2016 - 10:26 am 0I thought this character, who has failed miserably with YPF, had left to go back to where he came from - except I doubt they would take him now with the financial problems all oil related companies are facing.

YPF. What to do with them? Never really shown any potential, best to cut the losses and buy what they need on the spot market at present.

I am paying up the ass for fuel and they still can't turn a profit.

Mar 07th, 2016 - 12:04 pm 0They need to tell the unions to piss off as there is no money.

@2, I work in Neuquen or PAE, and agree with you 100%, the unions are killing Argentina, and even more so in the oilfield. I have worked in many different countries in my 20 years in the oilfield and have never witnessed the stupidity and absolute ridiculous demands of the oilfield unions that exist here in Argentina. The people who work in the oilfield are very highly paid, (much more than other groups), yet they continually complain and ask for more. The crisis in the oilfield is a world wide issue, but these idiots refuse to understand that reality. If I had the power, I would get rid of all unions period, they no longer serve a purpose in 2016, except to screw things up

Mar 07th, 2016 - 12:23 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!