MercoPress. South Atlantic News Agency

Argentine construction chamber admits 54.000 jobs losses in a “complicated transition”

“Argentina drags a decade of inflation higher to 20% and it is very difficult to generate public works and mortgage loans with these figures,” Chediack said

“Argentina drags a decade of inflation higher to 20% and it is very difficult to generate public works and mortgage loans with these figures,” Chediack said  The drop in construction jobs was a result of two factors: 2015 fiscal deficit that provoked the nonpayment of works, and high inflation

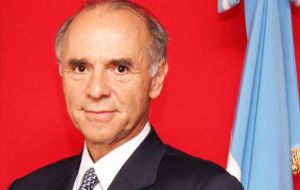

The drop in construction jobs was a result of two factors: 2015 fiscal deficit that provoked the nonpayment of works, and high inflation Argentina's Construction Chamber president Juan Chediack said 54,000 jobs have been lost in the sector since December. In statements to a local radio, Chediack pointed out the drop in construction jobs was a result of two factors: ”2015 fiscal deficit that provoked the nonpayment of works, and high inflation that pretty much stopped private developments, which are important job engines.”

“Argentina drags a decade of inflation higher to 20% and it is very difficult to generate public works and mortgage loans with these figures,” Chediack said adding Argentina is going through what he called a “complicated transition.”

“There is a lot of movement (in the government), we are very optimistic but also aware that we are going through a complicated transition which we had already forecast.”

As the clock ticks for the government to get the holdouts bill approved by the Lower House and finally enact the agreement with the speculative funds opening the door to debt issuance, sources reported Mauricio Macri’s administration is mulling a capital whitewashing plan to allow the return of dollars Argentines save abroad.

Speaking at a tax seminar held at the Professional Council of Economic Sciences, the head of AFIP tax agency Alberto Abad referred to the strategy of the fiscal administration.

Asked about a possible amnesty for taxpayers to regularize their situation regarding the exchange of international fiscal information, Abad didn’t rule out a possible capital whitewashing ”to balance the table for all traders.” “However, it will have a price,” he concluded.

Top Comments

Disclaimer & comment rules-

-

-

Read all comments' ....what he called a “complicated transition”.... '

Mar 10th, 2016 - 03:00 pm 0--Translation: Argentine economy is circling the toilet and the country is setting up for another devaluation coupled with another subsequent default. In spite of the rah-rah spin that the let's-all-invest-in-Argenzuela media are putting out.

“ ... a capital whitewashing plan to allow the return of dollars Argentines save abroad....”

-- Translation: Something every Argentine government does about every three weeks, in recognition of diminishing gross national product and the fact that no argento believes in the stability of the economy nor the artificially propped value of the ARS, nor the safety of one's savings in any Argentine bank. The average recovery of each new version nets about twelve dollars.

More importantly, each government's announcement of measures to “bring back dollars held by Argentines overseas” is greeted with such laughter that it is measurable on the Richter Scale and is clearly audible as far as Isla San Andrés, with predominant frequencies of around 1200 Hz.

The efforts are largely considered to be the Second Biggest Joke in all of Argentina and correlate to significant spikes in the sales of low-grade Fernet.

The “complicated transition” may be a simple return to normality. I know architects in BsAs who have been incredibly busy building property pretty much ever since the dollar clamp was enforced. The reason was that with the default option of saving in US$ being very restricted then the alternative was to build properties, your cash pesos would go into bricks and mortar which is likely to be a better investment than leaving them under the mattress or in the bank. Now, with the dollar clamp removed, the incentive to build purely as an investment has been removed too, so it is entirely predictable that the construction industry would come to a grinding halt.

Mar 10th, 2016 - 06:40 pm 0Now, of course, there will be a lot of surplus housing capacity which wasn't built to meet any specific need so the housing and rental market will each probably adjust accordingly. Not that complicated?

@2 “Now, of course, there will be a lot of surplus housing capacity ...”

Mar 10th, 2016 - 09:56 pm 0This surplus housing capacity must be why apartment contract renewals in GBA are seeing increases of 30 to 40 percent in the past couple of months. Average increase of reported 34.5 percent.

http://www.ieco.clarin.com/alquileres-buenos_aires-aumentos-inflacion-salarios-contratos_0_1448255373.html

So - soaring inflation impacts in housing AND a major slowdown in new construction leading to additional cost increases and higher inflation leading to Peronists demonstrating in the streets for price controls resulting in greater housing shortage. Let's all invest in Argentina !

@ 2 “....a simple return to normality...”

There is no normality in this country.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!