MercoPress. South Atlantic News Agency

Maduro announces “restructuring of all future debt payments”; default round the corner?

Maduro vowed to make US$1.1 billion payment on a bond maturing on Thursday, but also created a commission to study “restructuring of all future payments”

Maduro vowed to make US$1.1 billion payment on a bond maturing on Thursday, but also created a commission to study “restructuring of all future payments” Venezuela on Thursday announced plans to restructure its burgeoning foreign debt, a move that may lead to a default by the cash-strapped OPEC nation whose collapsing socialist economy has left its population struggling to find food and medicine.

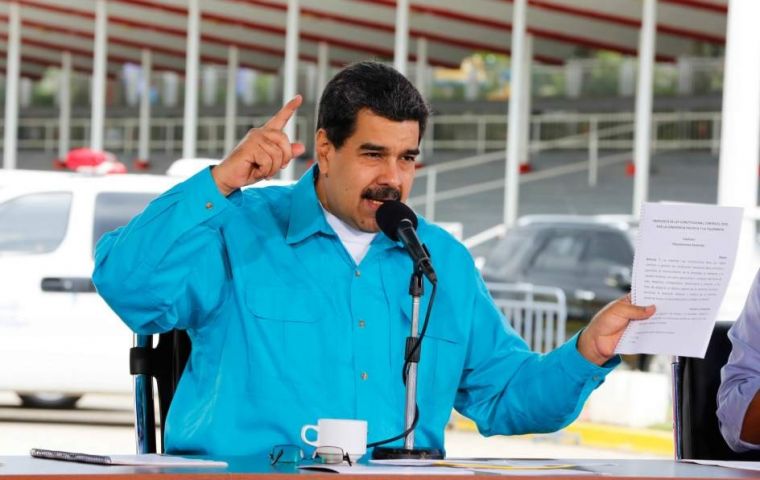

President Nicolas Maduro vowed to make a US$1.1 billion payment on a bond maturing on Thursday, but also created a commission to study “restructuring of all future payments” in order to meet the needs of citizens.

Venezuela has few avenues to do that though because of sanctions by the United States that bar American banks from participating in or even negotiating such deals. Thus, Maduro's most readily available recourse to ease payments is unilaterally halting them.

”I am naming a special presidential commission led by Vice President Tareck El Aissami to begin refinancing and restructuring all of Venezuela's external debt and (begin) the fight against the financial persecution of our country,“ Maduro said in a televised speech.

Venezuela and state-owned companies have US$49 billion in bonds governed by New York Law and promissory notes, according to New York-based Torino Capital. The government and state oil company PDVSA owe some US$1.6 billion in debt service and delayed interest payments by the end of the year, plus another US$ 9 billion in bond servicing in 2018.

The next hard payment deadline for PDVSA is an US$ $81 million bond payment that was due on Oct 12 but on which the company delayed payment under a 30-day grace period. Failing to pay that on time would trigger a default, investors say.

That would likely make countries less willing to do business with Venezuela, aggravating shortages of food and medicine and creating further problems for its all vital oil industry that is already hobbled by under-investment.

Wall St. for years pumped billions of dollars into Venezuela by way of bond purchases, passing off the revolutionary rhetoric of the ruling Socialist Party as bluster that belied an iron-clad willingness to pay its debts.

Maduro surprised many by maintaining debt service after the 2014 crash in oil prices, diverting hard currency away from imports of food and medicine toward Wall St. investors.

PDVSA carried out a debt renegotiation in 2016. But that option was taken off the table after U.S. President Donald Trump levied sanctions blocking the purchase of new debt issued by Venezuela and government-owned entities.

However investors seemed puzzled by Maduro's statements on Thursday, which neither clearly declared default nor laid out a path to easing payment burden.

”At no moment did he say they wouldn't pay, so it's not a default,“ said Alejandro Grisanti of Caracas-based consultancy Ecoanalitica. ”But in this environment, Maduro has no way to restructure or refinance as he said today.”

And the mere presence of El Aissami on the new debt commission makes it a non-starter for U.S. financial institution. He was blacklisted this year by U.S. Treasury Department on accusations he is involved in drug trafficking.

Venezuela's debt is the highest yielding of emerging market bonds measured by JP Morgan's EMBI Global Diversified Index, paying investors an average of 31 percentage points more than comparable U.S. Treasury notes. That is nearly double the spread on bonds issued by Mozambique, which is already in default, and more than six times the spread on bonds from war-torn Ukraine.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsSounds like rearranging the deck chairs on the Titanic to me...

Nov 04th, 2017 - 10:27 am +1This is what socialism (coupled with institutional corruption) does to a country.

Nov 04th, 2017 - 11:34 pm +1I wonder if Maduro will do a moonlight flit with whatever's left in the kitty.

I don't think he can hold it all together much longer....

Nov 03rd, 2017 - 10:44 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!