MercoPress. South Atlantic News Agency

Brazilian minister prepared to sell all “dysfunctional” state owned companies

Guedes and his team are pushing an ambitious, economic reform agenda of fiscal austerity, slashing the size of the state, widespread privatization and deregulation

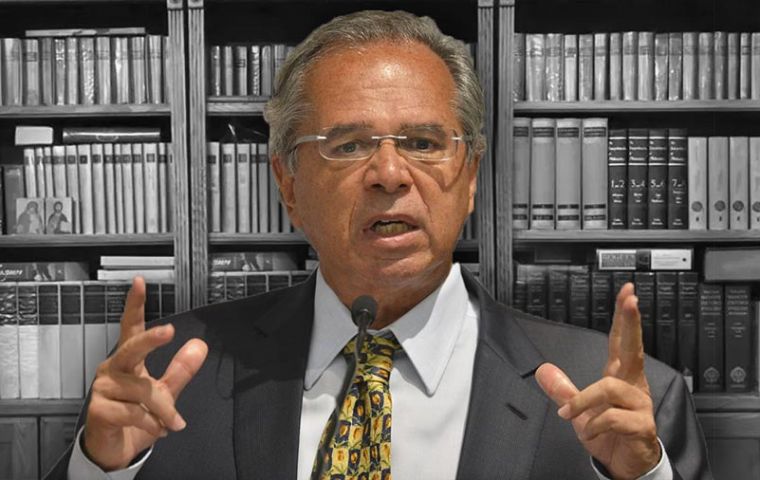

Guedes and his team are pushing an ambitious, economic reform agenda of fiscal austerity, slashing the size of the state, widespread privatization and deregulation Brazil’s Economy Minister Paulo Guedes said he will propose selling all the country’s state-owned companies because they are “dysfunctional” and should be privatized to improve the government’s finances.

In a wide-ranging address at a conference in the northeastern city of Fortaleza broadcast live on the internet, Guedes also said millions of jobs could be created as a result of the government’s plans to simplify Brazil’s complex tax system.

Guedes and his team are pushing an ambitious, economic reform agenda of tight fiscal austerity, slashing the size of the state, widespread privatization and deregulation.

Guedes repeated a previous pledge that if he had his way he would “sell everything”, arguing that this would free up much-needed resources for more “legitimate” needs of society.

The government’s goal is to raise US$ 20 billion from privatizations this year and is already well over half-way there.

Another means of injecting resources into the economy is the central bank reducing the amount of reserves banks must hold at the monetary authority. Guedes said that this could total 100-200 billion reais over the next four to five years, according to central bank president Roberto Campos Neto.

On tax reform, one of the government’s top economic priorities in the second half of the year, Guedes said there will be no “surprises” on income tax, but there will be a “dual” value-added tax that states may or may not opt into, as well as a transactions tax.

Guedes argued that a transaction tax, which has been met with widespread opposition in Brazil, is a steady tax and can reach informal sectors of the modern economy, such as Uber.

Brazil’s tax burden, currently around 33% of gross domestic product, will not be immediately altered by the government’s proposals. But Guedes said recently that ideally, he would like to see it reduced to 20% over the next 15 years.

Top Comments

Disclaimer & comment rules-

Read all commentsExcellent idea to sell “dysfunctional” state-owned companies! They should also get rid of the “Dysfunctional States” instead!

Sep 08th, 2019 - 11:12 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!