MercoPress. South Atlantic News Agency

Ecuador Sunday election, a return to heterodox populist economic policies?

Opinion polls point to a lead for left-leaning economist Andres Arauz, 35, who pledged last month to ignore the IMF agreement and increase social spending if elected

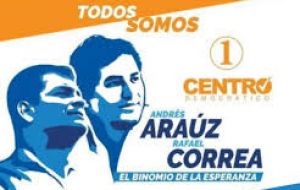

Opinion polls point to a lead for left-leaning economist Andres Arauz, 35, who pledged last month to ignore the IMF agreement and increase social spending if elected  Arauz is the option presented by ex populist president Rafael Correa, who has been barred from running on alleged corruption charges

Arauz is the option presented by ex populist president Rafael Correa, who has been barred from running on alleged corruption charges  Indigenous activist Yaku Perez and conservative banker Guillermo Lasso, who is making his third presidential bid, are Arauz’s closest rivals in the polls

Indigenous activist Yaku Perez and conservative banker Guillermo Lasso, who is making his third presidential bid, are Arauz’s closest rivals in the polls Uncertain times ahead for Ecuador, if after four years of orthodox economic policies to try and balance government accounts and restructure foreign debt are followed by promises of heterodox economics and populist handouts.

In effect after a swift and smooth restructuring, Ecuador’s sovereign bonds are being pummeled by fears that Sunday’s election outcome could derail ties with the International Monetary Fund and trigger another debt crisis.

Suffering one of the region’s worst outbreaks of coronavirus last spring, the oil-dependent Andean country secured in August a US$17.4 billion debt restructuring and a US$6.5 billion IMF fresh loan.

But opinion polls point to a lead in the presidential run for left-leaning economist Andres Arauz, 35, who pledged last month to ignore the IMF agreement and increase social spending if elected. Bond prices tumbled, deepening a slump stemming from the economic collapse during the pandemic.

Arauz is the option presented by ex populist president Rafael Correa, who has been barred from running on alleged corruption charges. Living in Brussels with his Belgian wife, the ex president will be imprisoned if he returns to his homeland. But things could change dramatically if his chosen successor manages to make it on Sunday or in the runoff 11 April.

Arauz promised to give US$1,000 each to a million families within a week of taking power, nearly 20% of FX reserves that stood at US$ 5.2 billion at the end of December.

Indigenous activist Yaku Perez and conservative banker Guillermo Lasso, who is making his third presidential bid, are Arauz’s closest rivals in the polls. Undecided voters, who poll in the double digits, will be key for picking the winner and also defining whether an April runoff will be needed.

A candidate will win outright with over 50% of the vote or over 40% and a minimum 10-point lead over the nearest rival.

The next president will have at hand over US$ 4 billion already disbursed by the IMF while enjoying a schedule of payments that will not make a big dent on the US$ 17.4 billion restructured with private creditors.

“The country’s ability to pay in the medium to long term is actually substantially better than before COVID, which is a bit counterintuitive,” said Carlos de Sousa, a manager of emerging market debt portfolios at Vontobel Asset Management.

“The debt servicing costs over the next five years are much lower than they were before, so the restructuring did a very good thing to improve the debt sustainability of Ecuador.”

Principal repayments on the country’s dollar bonds will kick in from 2026 onwards. But with bonds yielding over 15%, Ecuador is currently shut out of the market. That need not be a problem, but it could be under a government that spends its way out of the crisis.

“The way to fund (the country’s deficit) is through multilaterals, which come with significant conditions, or through the market, which is effectively closed, or through monetary financing,” said Patrick Esteruelas, head of research at Emso Asset Management in New York. “If they resort to monetary financing that’s the beginning of the end of the dollarization regime.”

Ecuador’s foreign currency bonds were the worst performers among the JPMorgan EMBI Global Diversified index last month, with a -15% total return. On a 12-month basis the return is -55%, the second-worst globally behind Lebanon. Ecuador joined Sri Lanka, Zambia, Venezuela, Lebanon, Belize and Argentina as countries with EMBIG spreads above 1,000 basis points.

Many of Sunday’s voters have never used local currency, since Ecuador has been dollarized for over 20 years. The move brought stability to the economy, which had been weighed by hyperinflation, but at the same time destroyed a lot of local wealth.

Monetizing the debt is a risk investors need to be aware of, according to Goldman Sachs analysts, who noted that “the implementation of a populist and heterodox policy agenda by an Arauz administration could undermine confidence in the dollarization regime.”

The effect of that confidence loss, the Goldman analysts said, could show up “potentially triggering a run on bank deposits and a full-blown financial crisis and eventually forcing the authorities to suspend debt service.”

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!