MercoPress. South Atlantic News Agency

US dollar soars in Colombia as Petro's inauguration looms over

As long as there is uncertainty, investments “will leave,” Duque stressed.

As long as there is uncertainty, investments “will leave,” Duque stressed. The Colombian peso Monday suffered a historic devaluation amid uncertainty less than a month ahead of President-elect Gustavo Petro's inauguration.

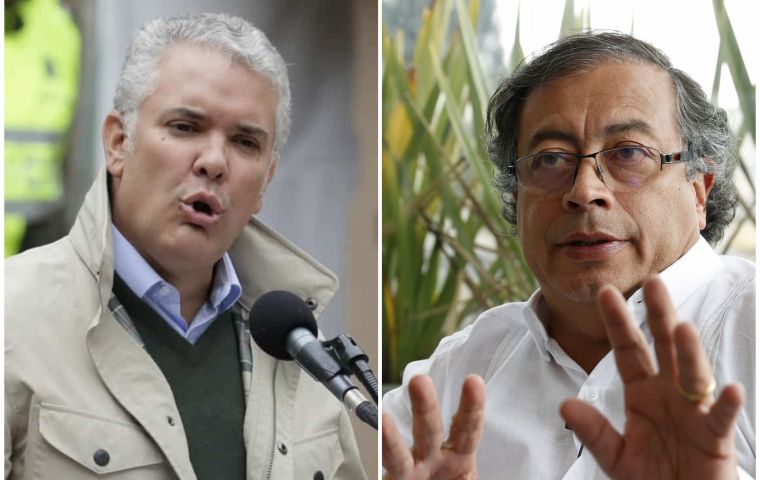

Incumbent conservative President Iván Duque asked the leftwing enthusiast Petro to produce some signs to appease a hesitant market.

Pero, a graduated economist, is about to receive a country on August 7 with a US dollar going up like in Argentina instead of down as is the case in Uruguay or Brazil.

According to the Banco de la República, one US dollar traded at 4,470 Colombian pesos in the early hours of Monday but closed at 4,513 pesos at the end of the business day, a figure unthinkable not so long ago for the only South American NATO ally.

The downfall of the Colombian peso began last week when it crossed the 4,300-peso threshold. In the last month, the local currency has lost 18% against the dollar, it was reported.

According to local analysts, the peso's devaluation stems from fear of what may happen under Petro's presidency, the first-ever of a different political background after 200 years of conservative and right-wing leaders.

“Looking at the numbers, it is quite scary given my knowledge of Colombia, which has had a very reasonable exchange rate over time,” Argentine economist Claudio Loser, a former director of the International Monetary Fund (IMF) for Latin America said in a radio interview in Buenos Aires Monday.

Loser also said the war in Ukraine and the new world scenario is to account for the economic jump, particularly after Washington's decision to increase local interest rates, which “hit all currencies” and resulted in central banks elsewhere following suit.

On June 30, Colombia's monetary authority raised the interest rate from 6% to the historic 7.5% to curb inflation, which is already above 9%.

Petro and his future Finance Minister José Antonio Ocampo are now expected to calm down the markets and not scare off investors. Duque insisted Petro gave some “signals” in that regard. “I think it is very important that there are signals that remove uncertainty in the country; when there is a message that generates uncertainty regarding long-term investment, regarding what may be coming with regimes that have to do with investment in the countryside and others, I think those things begin to generate this situation,” the incumbent president said.

Petro has announced a tax reform aimed at the wealthiest, which would entail an end to all exemptions. He has also spoken about an agrarian reform targetting owners of large, unproductive lands. In his campaign, Petro also vowed to end oil exploration.

Duque also pointed out that what is happening in his country is also taking place in Chile, where there is also a new leftist president, Gabriel Boric Font. As long as there is uncertainty, investments “will leave,” Duque warned while insisting he could not speak for the incoming government.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!