MercoPress. South Atlantic News Agency

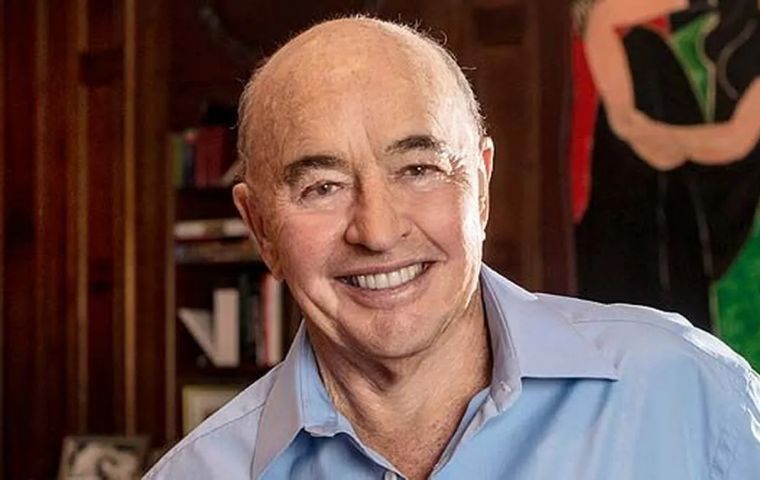

Insider trading charges in New York: Joe Lewis released on bail

Lewis pleaded not guilty

Lewis pleaded not guilty British tycoon Joe Lewis, who owns significant real estate properties in Argentine Patagonia, specifically in the Lago Escondido area, was released on bail by Federal Judge Valerie Figueredo in Manhattan after turning himself in to face insider trading charges, of which he pleaded not guilty.

Lewis is accused of offering information about publicly traded companies to close associates to benefit them in purchasing and selling shares. He pleaded not guilty to illegally giving confidential information about clinical and pharmaceutical companies to associates and friends.

Federal prosecutors accused Lewis, whose family trust controls a majority stake in the Tottenham Hotspur football team, of orchestrating a “brazen” insider trading scheme by passing tips on companies he invested in to friends, personal assistants, private pilots, and romantic partners.

Two of Lewis' pilots, Patrick O'Connor and Bryan Waugh, were also charged with insider securities fraud. According to the prosecution, they reaped millions of dollars in illegal profits from Lewis' tips.

Between 2013 and 2021, Lewis is said to have “abused his access to corporate boardrooms and repeatedly provided insider information to his romantic partners, his personal assistants, his private pilots, and his friends,” the prosecution maintains.

The 29-page indictment lists the 19 charges against the businessman, including several for “securities fraud.” Lewis faces up to 25 years in prison on the most serious charge.

”(Lewis) used inside information as a way to compensate employees and make gifts to friends and lovers,“ Damian Williams, US Attorney for the Southern District of New York, said in a statement. According to the indictment, Lewis and his associates were able to collectively make millions of dollars using the ”stolen” information.

In one case, Lewis learned of promising clinical trial data at pharmaceutical company Mirati Therapeutics through a hedge fund he controlled and then urged a girlfriend, a personal assistant, and two private pilots to buy Mirati stock before the news broke; in the case of the pilots, he loaned US$ 500,000 each to buy more shares.

In addition, according to prosecutors, Lewis told his girlfriend about an upcoming transaction and the results of a clinical trial involving Solid Biosciences. Shortly after, she spent US$ 700,000 on company stock.

Prosecutors also charged Lewis with conspiring to make it appear that his stake in Mirati was minor through a series of shell companies, including one allegedly created for the benefit of his granddaughter; and making false statements to the Securities and Exchange Commission.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!