MercoPress. South Atlantic News Agency

How Arbitrage Betting Breaks the Rules

Modern arbers rarely search for these discrepancies manually

Modern arbers rarely search for these discrepancies manually In the vast ecosystem of the gambling industry, there is a fundamental rule that keeps the lights on: the house always holds the edge. Whether it is the spinning roulette wheel or the fluctuating odds of a football match, the mathematical probability is tilted in favor of the operator.

However, there exists a subset of market participants who refuse to accept this statistical disadvantage. They are not gamblers in the traditional sense; they are arbitrageurs. Engaging in “arbitrage betting” (or “arbing”), these individuals exploit market inefficiencies to secure a guaranteed profit regardless of the sporting outcome, effectively turning the volatile world of sports betting into a low-risk investment vehicle.

To understand arbitrage, you must first understand how bookmakers make money. When a bookmaker sets odds for an event—say, a tennis match between Nadal and Federer—they do not offer “true” odds. Instead, they build in a margin called the “overround.” If the true probability of each winning is 50%, a fair book would offer odds of 2.00 on both. Instead, a bookmaker might offer 1.90* on both, ensuring that if their book is balanced, they keep a percentage of the total money wagered.

*If you’re working with us odds, you can use a us odds converter, which is built into many arbitrage betting scanners.

Arbitrage occurs when different bookmakers hold different opinions on the same event, or when they react to market news at different speeds.

- The Opportunity: Bookmaker A might be slow to react to an injury update and keeps Nadal as the favorite. Bookmaker B, a “sharp” bookie, reacts instantly and slashes Nadal’s odds while boosting Federer’s.

- The Gap: If the odds on Nadal at Bookmaker A and Federer at Bookmaker B are both sufficiently high, the implied probability of all possible outcomes adds up to less than 100%.

- The Profit: By betting on Nadal with Bookmaker A and Federer with Bookmaker B, the bettor locks in a profit. It doesn't matter who wins; the combined return will exceed the total investment.

While the mathematics suggests “free money,” the profit margins is typically limited between 1% and 7% per surebet placed in prematch mode. That’s why arbers should place at least 5 arbs a day to ensure a tangible income.

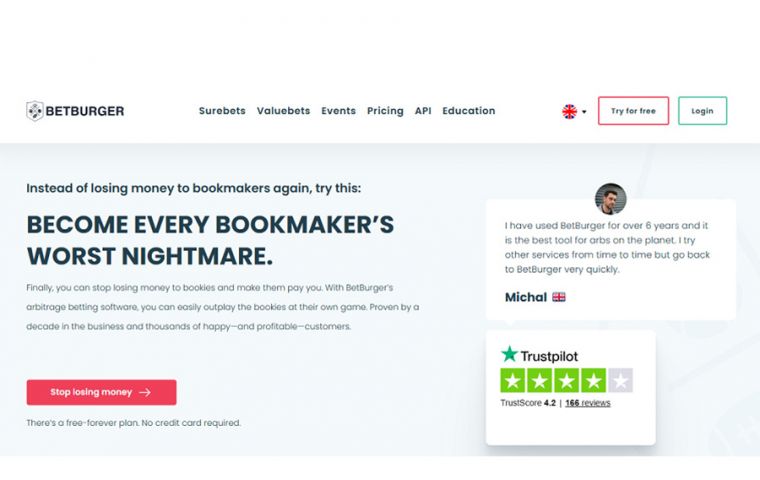

Modern arbers rarely search for these discrepancies manually. They rely on sophisticated alert services and software (eg, BetBurger) that scrape thousands of odds from hundreds of bookmakers in real-time. When an arb is detected, the software sends information to customers, and they need to visit the bookies' websites, place bets, and wait for the settlement.

As for the above-mentioned BetBurger, this software also has many additional tools, which help in operating with surebets. E.g., a surebet, ev+, and the odds parlay calculator, close odds, accounting feature, and many others.

Arbitrage betting is a fascinating anomaly – a way to beat the bookie using the house's own numbers.

For those with the discipline and speed to exploit the strategy, it remains one of the few ways to turn the tables on the gambling industry.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!