MercoPress. South Atlantic News Agency

The Next Generation of CRE: Exploring the Best Sites Like LoopNet for Buyers and Brokers

To compare commercial real estate platforms in a fair and useful way, this overview looks at the depth of available features

To compare commercial real estate platforms in a fair and useful way, this overview looks at the depth of available features Commercial real estate sits in a moment of quiet upheaval. For a long time, investors, brokers, and owners worked within the limits of static portals and phone-heavy relationships, tracing opportunities through listings that rarely changed and networks that moved at their own pace. Today, a mix of new technology, shifting capital flows, and more data-driven habits is reshaping how people find and interpret property.

The shift feels subtle at first and then unmistakable: static lists turn into data-rich gateways, filters give way to predictive scoring, and acquisitions become part of repeatable workflows rather than one-off discoveries. Crowdfunding and fractional ownership models add another layer, creating paths for smaller investors who might once have viewed CRE as out of reach. For buyers, brokers, and passive participants, the expectations have changed in ways that would have been rare even five years ago.

Anyone piecing together a first small retail center or adjusting a mature institutional portfolio is now navigating a far more varied digital ecosystem. Understanding how these platforms differ has become part of the investment craft.

Top Real Estate Platforms

Ranking Methodology

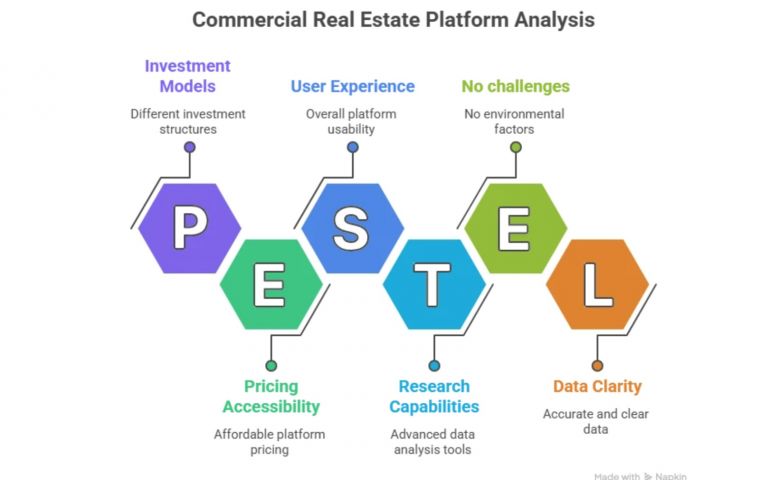

To compare commercial real estate platforms in a fair and useful way, this overview looks at the depth of available features, the clarity of data, pricing accessibility, overall user experience, research capabilities, and how each platform handles different investment models. Full ownership, fractional arrangements, tokenized structures, and crowdfunded opportunities all factor into the picture. The goal is not to declare a single winner, but to help readers notice which combinations best match their own strategies.

Platform #1 — LoopNet

LoopNet remains the largest commercial listing environment, offering hundreds of thousands of active properties and heavy buyer traffic. It is often the first stop for scanning a market. Users can sort through wide-ranging asset classes, review basic comparable data, and narrow locations through mapping tools.

The advantages are familiar: a vast pool of listings, strong visibility, and reasonably solid filters. The drawbacks appear just as consistently. Competition for worthwhile deals can be intense, listing packages are costly for brokers, and the interface carries the weight of an older generation of CRE tools.

Platform #2 — Realmo

Realmo positions itself as an AI-powered investment workspace and marketplace rather than a digital notice board. The platform aggregates commercial listings nationwide and layers them with real-time underwriting, investor-intent modeling, and predictive scoring, so an investor can move from an interesting property to a structured thesis in only a few minutes. Instead of juggling spreadsheets or scattered PDFs, users stay within a single environment built specifically for investor decision-making, covering both on-market and off-market opportunities.

Platform #3 — Crexi

Crexi grew from the frustrations of professionals who had lived with legacy systems. The result is a marketplace that blends listings, auctions, and marketing tools inside an interface that feels modern and easy to learn. Mapping and search features stand out, and the marketplace remains active on both the buying and selling sides.

Its design is approachable and efficient, although the overall inventory remains smaller than LoopNet’s. Some of the more advanced analytics sit behind paid tiers.

Platform #4 — CityFeet

CityFeet is a commercial real estate listing platform (part of the CoStar network) with a strong footprint in urban markets, especially New York City, but coverage across all U.S. states. It lists investment properties, apartments, hotels, office, retail, and more.

Best for: Investors and brokers focused on dense urban CRE, particularly multifamily and mixed-use assets in major metros.

Platform #5 — QuantumListing

QuantumListing keeps its focus on affordability and accessibility. Basic search functions do not require membership, and brokers often appreciate the straightforward pricing model along with simple team collaboration tools. It serves as a practical listing board for smaller firms and regional groups.

The trade-off is clear: the platform offers limited analytics and research features, and it behaves more like a traditional listing site than an investment analysis environment.

Platform #6 — Showcase

Showcase is another CoStar-owned marketplace offering thousands of commercial listings for sale and lease, with a focus on high-quality photos, floorplans, and pricing details.

Best for: Investors and brokers who prioritize visual detail and marketing quality when assessing or promoting assets.

Platform #7 — PropertyShark

PropertyShark is a real estate data platform focused on delivering deep property reports: ownership, building characteristics, sales history, zoning, foreclosure data, and more, with particularly rich coverage in New York City and other major U.S. markets.

It’s widely used by brokers, investors, developers, and researchers who need granular data for underwriting and outreach.

Best for: Investors and brokers who need verified ownership and detailed property history to underwrite deals or originate off-market opportunities.

Platform #8 — CoStar

CoStar remains the standard reference point for data in institutional circles. It brings extensive market analytics, deep verified datasets, and a broad view of property performance across regions and asset classes. Lenders, appraisers, and large-scale investors often rely on its detailed reports.

The strengths come with a steep cost. The pricing is high, there is no free option, and the feature set is more than many small or early-stage investors require.

Conclusion

Commercial real estate discovery is no longer defined by static listings or slow information cycles. Legacy platforms still matter, but the newer generation of tools has shifted expectations around transparency, speed, and the kinds of intelligence buyers bring into each decision. The landscape continues to stretch in new directions, leaving investors to decide which mix of old reliability and new capability fits the way they work.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!