MercoPress. South Atlantic News Agency

Bush defends 60 years of free-market system success

Bush: 'It would a terrible mistake to allow a few months of crisis to undermine 60 years of success'

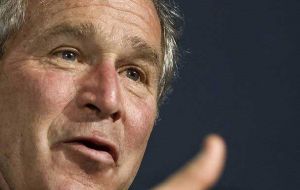

Bush: 'It would a terrible mistake to allow a few months of crisis to undermine 60 years of success' US President George W Bush has admitted the financial system needs reforming, but insists the credit crunch was not a failure of the free-market system. Speaking Thursday in New York, Mr Bush said that while financial markets did need some new regulation and more transparency, free trade should not be restricted.

His comments come before world leaders meet in Washington at the weekend to discuss the global economic downturn. Mr Bush said bold government measures had already helped improve matters. Yet he said state action was not a "cure-all", and what was now needed was a reform of the global economy "without trying to re-invent the system". He has called for improved accountancy rules, better co-ordination of national laws and regulations, and making the World Bank and the International Monetary Fund more representative. Mr Bush's comments seemed to please investors, as America's main Dow Jones index ended up 6.7%. Although analysts said most of the gain was due to bargain hunters picking up cheap stocks following three straight days of falls. Returning to the cause of the credit crunch, Mr Bush admitted that failures had been made "by lenders and borrowers, by financial firms, by governments and independent regulators". But that the answer was "not to try to reinvent the system". Instead, he said the solution was to "fix the problems we face, make the reforms we need, and move forward with the free market principles that have delivered prosperity and hope to people around the world". He added that while capitalism was "not perfect", it was "by far the most efficient and just way of structuring an economy". "It would a terrible mistake to allow a few months of crisis to undermine 60 years of success," said President Bush. Ahead of the summit, French President Nicolas Sarkozy said the US dollar was no longer "the only global currency". Speaking at a ceremony in Paris, Mr Sarkozy said times had changed since the Bretton Woods conference after World War II laid the foundations of modern financial institutions. "What was true in 1945 can no longer be true today," he said. French Finance Minister Christine Lagarde said the strength of the Euro was making it more attractive than before. But she cautioned creating further instability through a major shift in central banks' currency reserves. The summit in Washington brings together leaders of the world's biggest democracies, emerging nations and international organisations.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!