MercoPress. South Atlantic News Agency

Wiesel foundation looses all assets to Madoff's Ponzi fraud

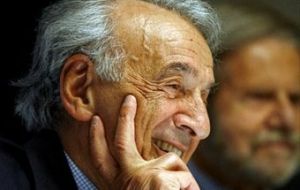

Nobel laureate Elie Wiesel

Nobel laureate Elie Wiesel The Elie Wiesel Foundation for Humanity lost more than 15 million US dollars, nearly all of its assets, in the fraud scheme run by Wall Street financer Bernard Madoff, the fund said Wednesday in a short release.

"We are writing to inform you that the Elie Wiesel Foundation for Humanity had 15.2 million dollars under management with Bernard Madoff Investment Securities," said the foundation whose aim is to combat anti-Semitism. "This represented substantially all of the foundation's assets" it added. "We are deeply saddened and distressed that we, along with many others, have been the victims of what may be one of the largest investment frauds in history." The statement concludes saying that "the values we stand for are more needed than ever. We want to assure you that the Foundation remains committed to carrying on the lifelong work of our founder, Elie Wiesel. We shall not be deterred from our mission to combat indifference, intolerance, and injustice around the world". Elie Wiesel, 80, a Nobel laureate and prolific author who survived the Holocaust, created the foundation two decades ago to foster international dialogue and youth programs to teach tolerance. He is among dozens of wealthy Jews to have lost substantial amounts of money in Madoff's scheme. Prosecutors say Madoff confessed to losing upwards of 50 billion USD over years of running a Ponzi scheme, where new investors were secretly fleeced to pay returns to earlier investor The 70-year-old former chairman of the Nasdaq stock market and a mainstay of the powerful American Jewish community is currently under house arrest on bail of 10 million dollars with all his assets frozen as police continue their probe. In related news French investment manager who put 1.4 billion into Madoff's fraud scheme killed himself in his New York office, police said. Rene-Thierry Magon de la Villehuchet, 65, was found sitting at his desk with both wrists slashed. Mr Villehuchet, who was married without children, was co-founder of money manager Access International. Other victims include Liliane Bettencourt heiress of the cosmetics corporation L'Oreal, with a fortune of 23 billion US dollars. She invested through Access International Advisors. Hollywood's director Steven Spillberg has also been mentioned. Another investor who gave Madoff 2 million US dollars to manage has taken legal action against US financial regulators. Phyllis Molchatsky, a 61-year-old retiree from New York, is seeking 1.7 million in damages from the US Securities and Exchange Commission. It is believed to be the first attempt by an investor to recover losses from the SEC.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!