MercoPress. South Atlantic News Agency

Brazilian Central Bank not surprised by steady gain of the Real

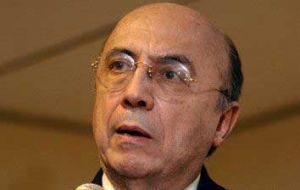

Meirelles: “Brazil's government took timely measures to combat the crisis.”

Meirelles: “Brazil's government took timely measures to combat the crisis.” Brazilian Central Bank President Henrique Meirelles said Tuesday that there are signs that the economy is recovering although he offered no specifics. Brazil’s economy expanded 5.1% in 2008 but government forecasts have been downgraded to 1% for 2009, and private estimates are even more pessimistic

“We are already seeing signs that point to an economic recovery by 2010” Meirelles said at an investment seminar. “Brazil's government took timely measures to combat the crisis. Brazil's economy is solid because of this effort”.

Meirelles noted that such policies have included building foreign reserves, which currently stand at 205 billion US dollars, increasing credit availability and cutting taxes to stimulate consumer demand.

The Central Bank president did specifically address the strong Real which has motivated reactions from Brazilian exporters, who feel they are loosing competitiveness and hard to retain foreign markets.

Meirelles said the central bank's focus will continue to be monetary policy. He said the central bank has no direct or immediate responsibilities when it comes to foreign exchange policy.

“We are not going to try to set foreign exchange policy by means of monetary policy” he said. “The foreign exchange rate responds to a number of factors. The foreign exchange market is responsible for dealing with those factors. The role of monetary policy is to stabilize the domestic economy and maintain inflation under control.”

Brazilian inflation in 2008 was 5.9% but that rate is likely to fall below 5% in 2009, according to most economists.

Meirelles said the only direct role for the central bank in the foreign exchange market was to make timely interventions “with a view to avoiding abrupt market shifts” and he added that “the government's job is to counter waves of both euphoria and pessimism.”

In recent weeks, the central bank has intervened in the foreign exchange market through nearly daily snap auctions to buy US dollars. The auctions come at a time when the Brazilian Real has been steadily gaining against the US dollar.

The central bank has been under pressure to cut interest rates as a way of making Brazilian fixed-income investments less attractive to foreign investors. Brazil's base rate is currently 10.25%, attracting heavy foreign investment inflows that have helped strengthen the Real against the dollar.

Since early March, the Brazilian Real has risen from 2.44 to the US dollar to the current 2.04.

In related news the Central Bank also announced a current account surplus of 146 million US dollars for the month of April, the best performance in almost 19 months.

However Altamir Lopes head of the Central bank’s Economic Research Department said that the surplus in the current account “is not a trend” and may not repeat itself in following months. Speaking with reporters in Brasilia he forecasted Brazil will probably post a 2.3 billion deficit in May as the Real strengthens.

Foreign direct investment in Brazil for April totalled 3.41 billion USD and could reach 2.6 billion USD in May, added Lopes.

According to the Central bank, exports contributed 3.71 billion USD to the current account balance last month, compared with a 1.74 billion in April 2008. International companies reduced profit and dividend remittances by 57.3% from January to April 2009 to 5.27 billion USD.

“These figures show interest in the country by foreign investors,” Lopes told reporters in Brasilia. “They’re looking at Brazil with a long-term perspective”.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!