MercoPress. South Atlantic News Agency

UK to announce sweeping banking reform this week

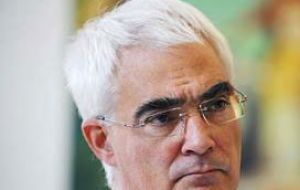

Chancellor Alistair Darling promises an end to “kamikaze” bankers

Chancellor Alistair Darling promises an end to “kamikaze” bankers The United Kingdom Chancellor Alistair Darling has hit out at “kamikaze” bankers for damaging the British economy and said a shake-up to be unveiled this week would prevent a repeat.

He has already indicated that this week's banking reform White Paper will include new powers for the Bank of England and Financial Services Authority.

Writing in the News of the World he said regulators would be able to ask “searching questions” and be “ready and able to deal with failures when they arise”.

He said: “We need to learn lessons from the financial crisis in which banks behaved in a kamikaze manner and the regulatory system failed.

”Far too many people in boardrooms did not know, nor understand what was happening in their institutions. We know now that no authority in the world understood the true risks to the system or the likely consequences. That needs to change.

“I want a new banking system we can all rely on and which will be the foundation of our new prosperity.”

The proposed reforms would “deliver tougher regulation and more rigorous monitoring and managing of system-wide risks so we can make sure we are ready and able to deal with failures when they arise,” he said.

“Regulators will get powers to do their jobs more effectively, to ask searching questions of the institutions. Businesses need to be able to borrow. Families need to get mortgages. The stakes are high but a stable financial world is a goal we are determined to achieve.”

Mr Darling on Friday played down reports of a turf war between Bank of England governor Mervyn King and the FSA, led by Lord Turner, over who will wield powers to regulate the banks.

He indicated that the White Paper will retain the “tripartite” regulatory system, which divides responsibility between the Bank, FSA and Treasury.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!