MercoPress. South Atlantic News Agency

UK government borrowing soars and is equivalent to 56% of GDP

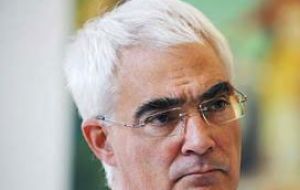

Chancellor Alistair Darling borrowing to boost the economy

Chancellor Alistair Darling borrowing to boost the economy The United Kingdom government borrowing swelled by £13 billion in June to take overall net debt to its highest proportion of UK output since records began, official figures showed.

Public sector net borrowing in June saw the nation's net debt soar to £798.8 billion, which is equivalent to a record 56.6% of gross domestic product (GDP), according to the Office for National Statistics (ONS).

June's borrowing was £5.5 billion higher than the £7.5 billion seen a year ago, which also marked a record for the month.

The ONS data revealed the impact of recession on tax receipts, with corporation tax takings plunging by 14.1%, VAT by 15.9% and income tax by 3.9%.

But spending rose again as the Government sought to tackle the economic woes, with social benefit outlays up 9.7% to £13.3 billion as it pumped more cash into unemployment benefit payouts. Total Government outlay over June hit £49 billion, up from £44.2 billion a year earlier, while total receipts fell 5.7% to £35.5 billion.

The figures paint a stark picture of UK public finances and come amid mounting concern over borrowing levels.

Bank of England Governor Mervyn King recently highlighted concerns, branding the Government's borrowing levels “extraordinary”. Chancellor Alistair Darling predicts net borrowing over the year as a whole will hit £175 billion.

But economists fear it could reach as high as £190 billion this year as the Government seeks to spend its way out of recession.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!