MercoPress. South Atlantic News Agency

Bernanke reaffirmed low interest rates for an extended period

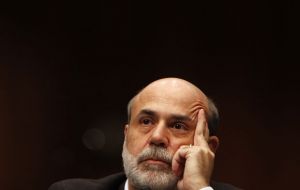

US Federal Reserve chairman Ben Bernanke

US Federal Reserve chairman Ben Bernanke United States stocks rose on Wednesday after the Federal Reserve chairman reaffirmed his commitment to keep interest rates low for an extended period to sustain the still fragile recovery. Ben Bernanke told Congress a weak job market and tame inflation warranted keeping rates close to their near-zero level for the time being.

Overall he gave a sombre view of the economy, which was echoed by a separate US report that showed new home sales unexpectedly slumped to a record low in January. Investors appeared to shrug off the negative signs emerging from the property sector, instead taking heart from the promise of low rates.

The US has lost 8.4 million jobs in a little more than two years in the most severe economic downturn since the Great Depression. The Fed boss said job losses were abating but also acknowledged the recession's toll on US workers.

“Notwithstanding the positive signs, the job market remains quite weak,” he told the US House of Representatives Financial Services Committee. Even when the recession continues to abate “the job market has been hit especially hard“.

The Fed chairman said he's particularly worried about the long-term impact on workers skills and wages and the increasing incidence of long-term unemployment.

”Indeed, more than 40 percent of the unemployed have been out of work six months or more, nearly double the share of a year ago,” he said.

The dollar weakened against major currencies in afternoon trading while the Dow Jones industrial average rose sharply after the comments.

Mr Bernanke's testimony was his first appearance since the central bank raised the rate on emergency loans last week. That news had been taken as a sign of an imminent tightening of fiscal policy.

While the move was anticipated, the timing was sooner than expected.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!