MercoPress. South Atlantic News Agency

Brazil reacts cautiously to the Yuan “greater flexibility” policy

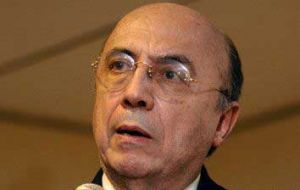

Central Bank governor Henrique Meirelles

Central Bank governor Henrique Meirelles Brazil's Central Bank welcomed China's move to boost flexibility of the Yuan exchange rate, saying the decision showed China's willingness to help the global economy.

China announced on Saturday that it would resume making the Yuan more flexible, signaling that it was ready to break a 23-month-old peg to the dollar that had come under intense international criticism.

“The announcement by the Chinese central bank regarding greater fluctuation of the Yuan, is welcome,” Central Bank President Henrique Meirelles said in a terse statement.

“It shows the disposition of the Chinese government to contribute to greater global economic equilibrium. But we need to wait to see what the effects will be” added Meirelles who underscored that how and at what speed it will be implemented are still unknown.

Analysts believe China announced the decision in part to reduce tensions at the upcoming Group of 20 meeting of nations in Canada following months of pressure from Washington and charges from around the world that it was manipulating its currency to favor its export sector.

China is Brazil's largest trading partner, importing large amounts of commodities including soy, petroleum and iron ore.

Meantime the Yuan on Monday soared to its highest against the dollar since the landmark 2005 revaluation, with the central bank stepping aside and tolerating broad gains on the first trading day since scrapping the currency's two-year peg to the dollar.

The central bank declined to intervene, one of the few times in the Yuan's modern history that is has stepped aside, and appeared to want the market to drive intraday trade, backing up its weekend pledge to allow greater flexibility.

From Beijing the official Chinese news agency Xinhua said that the announced Yuan flexibility policy signaled the end of the “crisis-focused” policy the government displayed to cushion the impact from the global financial crisis.

The decision was made in view of the recent economic situation and financial market developments at home and abroad, as well as due to the balance of payments situation in China, the central bank said. However, it ruled out a one-off revaluation of the Yuan as there was no basis for large changes in its value.

Zhao Xijun, deputy dean of the School of Finance with the Renmin University of China, said the normalization of China's exchange rate policy would intensify China's economic connection to the global economy and help promote the country's economic restructuring and adjustments of its development policy.

Zhou Xiaochuan, governor of China’s central bank in March anticipated that the exchange rate policy China took amid the crisis was part of the government's stimulus packages, and would exit “sooner or later” along with other crisis-measures.

China's economy expanded at 11.9% year on year in the first quarter of this year and exports surged 48.5% in May, government data showed.

Zhao said China narrowed fluctuation of the Yuan exchange rate to stabilize market sentiment and stimulate economic growth amid crisis, which was in the interests of China and contributed to the country's economic recovery.

Top Comments

Disclaimer & comment rules-

Read all commentsH.Meirelles --------------------------------------------

Jun 22nd, 2010 - 01:03 pm 0We will set up a new and other Econ0mic Organization with

China ,Japan and some other Countries who have wanted eligible

indicators....

yul , Germany 22/6/2010

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!