MercoPress. South Atlantic News Agency

Rousseff admits she is “immensely worried” with inflation

Brazilian president Dilma Rousseff promises “not to let the guard down”

Brazilian president Dilma Rousseff promises “not to let the guard down” Brazilian President Dilma Rousseff said on Monday she is “immensely worried” about inflation near the top of the official target range and that the government will act to keep prices from rising further.

“We are immensely worried about inflation, and there's no situation under which the government would let its guard down when it comes to controlling inflation” Rousseff told reporters in Brasilia.

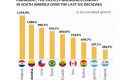

Inflation reached 6.44% in the year through mid-April, showed the most recent data available, the fastest since November 2008. The central bank's target range for inflation is 4.5% with a tolerance band of 2 percentage points.

The Brazilian central bank raised its Selic lending rate on Wednesday to 12% from 11.75%, a smaller hike than most economists had expected, in an effort to subdue rising prices.

Economists expect consumer prices will rise 6.34% this year, up from a week-earlier forecast of 6.29%, according to an April 20 survey of about 100 economists published Monday.

“There’s nothing to trigger a retreat in inflation,” said Jankile Santos, chief economist at Espirito Santo Investment Bank in Sao Paulo. “With last week’s rate decision, this makes that case even stronger”.

Policy makers aim to bring inflation back to target in 2012 as the cost of meeting the goal this year would be excessive in terms of lost output, the central bank said in its quarterly inflation report published in March.

The Central bank will rely on a variety of tools beyond raising interest rates to contain consumer prices, policy makers said in the report. A 50.7 billion Real (32.3 billion USD) spending cut mixed with so-called macro-prudential measures, such as higher reserve and capital requirements, taxes on consumer loans, will slow demand that helped the economy grow at the fastest pace in more than two decades last year, they said.

Rousseff’s administration on March 29 increased to 6% a tax on new corporate loans and debt sales abroad by banks. A few days later, she applied the higher tax to renewed, renegotiated, or transferred loans of up to two years in length. Companies previously paid a 5.38% tax on loans up to 90 days and zero tax when the operation exceeded three months.

The government also doubled the so-called IOF tax levied on consumer credit to 3% a year. In October, Finance Minister Guido Mantega tripled to 6% a tax on foreign investors’ fixed-income purchases.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!