MercoPress. South Atlantic News Agency

For Latam the role of the Yuan as an international currency is “inevitable”

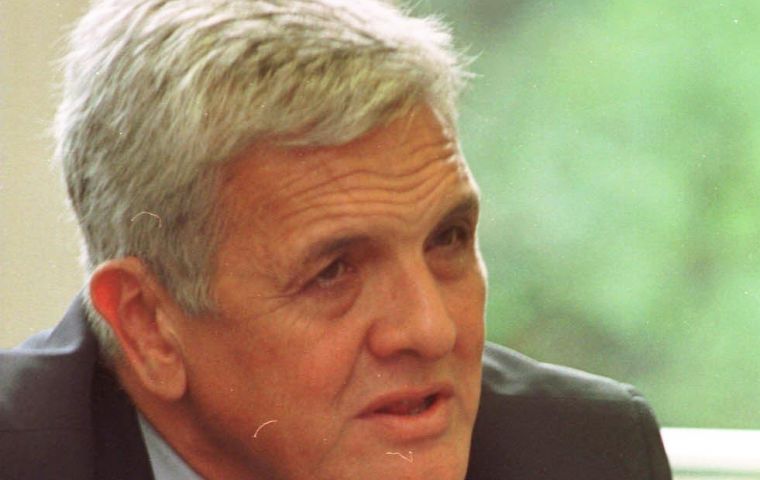

Jorge Castro said China’s contribution to the world is to keep growing at current rates

Jorge Castro said China’s contribution to the world is to keep growing at current rates The role of the Yuan as an international currency is “inevitable” and it is most feasible that Latin American countries will begin accumulating foreign exchange reserves in that currency forecasted an Argentine expert in foreign relations.

In an interview with China’s government agency Xinhua, Jorge Castro, head of the Strategic Planning Institute from Argentina said that “China’s greatest contribution to the world is to keep growing strongly not only in 2011 but also in the next 10,20,30 years”.

“China’s political strategy is long term and the growing weight of the Yuan is linked to the Asian countries influence in the world economy, so that the international role of the Yuan, together with the dollar and the Euro, is an inevitable process on the move”, said Castro.

The Asian power is developing in “a careful but sustained, and at different fields the internationalization of the Yuan”. Among steps in that direction is the fact London has chosen the Chinese currency to operate in developing countries which should have a positive impact for Hong Kong.

Zhou Xiaochuan, governor of China’s central bank recently stated that Beijing “is in no special urgency” to have the Yuan included in the basket of currencies that help calculate the Special Drawing Rights, SDR, the IMF money unit.

Zhou said that the Yuan internationalization is a slow, long process and London’s decision to help Hong Kong become an international monetary centre is very positive because it will play an important role in the development of China.

Regarding the possibility that Latin American countries begin using the Yuan as international reserves because of the growing trade with China, the Argentine expert recalled that Korea, which has a very close and intense relation with Beijing, has a significant percentage of its reserves in Yuan bonds.

“Maybe Latin America will do the same in a short time because bilateral trade between Asia and South America, Brazil and Argentina, is rapidly increasing”, said Castro.

“I believe as absolutely inevitable that Latin American central banks will want to hold a percentage of their international reserves in the Chinese currency”, added Castro.

According to the UN Economic Commission for Latin America and the Caribbean, China is the main export market for Brazil and Chile and second for Argentina, Peru, Cuba and Costa Rica. ECLAC forecasts that by 2013 China will become the main export market for the region, and the region’s second supplier.

Earlier in the month Inter American Investment Corporation, IIC, belonging to the Inter American Development Bank signed an agreement with the Bank of China that will allow companies from Latin America to obtain credit in renminbis (Yuan), the first time that a multilateral financial institution has created such an instrument making use of the Chinese currency.

The IDB also signed an agreement with the Export-Import Bank of China to provide up to 200 million dollars in short-term trade financing that will allow transactions to be carried out in the Chinese currency renminbi.

Top Comments

Disclaimer & comment rules-

Read all commentsI really don't think Argentina will be accumulating Yuans, dollars or any other currency reserves.

Oct 01st, 2011 - 07:03 pm 0So much borrowing,

so much debt,

so much default,

so much inflation,

so much unreality.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!