MercoPress. South Atlantic News Agency

Floater options under consideration for Darwin offshore Falklands development

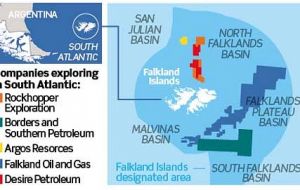

B&S operates in the southern basin of the Falklands

B&S operates in the southern basin of the Falklands Oil and gas exploration company Borders & Southern, B&S, expects to start work this month on two projects concerning its licenses in the offshore South Falkland basin, reports from London ‘Offshore’.

Last April the company discovered gas/condensate with a well on the Darwin prospect. B&S plans to reprocess a 3D seismic survey performed in 2008, and to acquire about 1,100 sq km of new 3D seismic.

Both surveys will be merged to assist with interpretation of key play fairways and maturation of B&S’ prospect portfolio. To date it has identified nine Early Cretaceous structures with potential reserves in the range of 120-720 MMbbl recoverable, and various other leads.

Many are within 3-10 km of the Darwin discovery. In addition, there are numerous Late Cretaceous and Tertiary prospects reported.

During 4Q 2012, the company commissioned E&P, part of the ThyssenKrupp Group, to perform a screening feasibility study for development of Darwin East and West.

The conclusion was that both are technically viable as standalone projects, phased, or combined as a parallel development with total production up to 56,000 b/d of condensate. Despite the harsh environment and lack of infrastructure in the Falklands area, development appears feasible using currently proven technology.

The most likely scenario would be sub-sea wells tied back to an FPSO for processing and storage of the condensate with gas re-injected into the reservoir to maximize liquids recovery. Condensate stored on the FPSO could be offloaded to shuttle tankers. Potentially, development could take three years from project sanction to first production.

Capex estimates range from 2.73 billion dollars for Darwin East as a standalone project using a purchased FPSO, to 1.585 billion if the FPSO were leased. A combined Darwin East and West development could cost 3.77 billion with a purchased FPSO, or 2.435 billion if the vessel were leased.

Another study by an independent consultant suggests a 200 MMbbl development would be commercial at an oil price of 65 dollars bbl, while a 100 MMbbl development would require oil price of at least 85 dollars bbl.

The next step for B&S is to prove up recoverable volumes in Darwin via appraisal drilling and to confirm the predicted flow rates with a well test.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsOh dear Nestor Kirchner - you tore up that Falkland Hydrocarbons deal with the UK denying the Argentine a share in the spoils.

Feb 18th, 2013 - 05:03 pm 0Yes, but his mom will be in Hades to keep him company, she pegged it yesterday at the age of 92.

Feb 18th, 2013 - 05:17 pm 0She who spawned this boss-eyed crook can now go and kick him in the knackers for ballsing it up for everybody in AR. If you believe in that sort of thing!

Woooooooooooooooooooooooooooooooooooooooooooooow……..

Feb 18th, 2013 - 05:23 pm 0What a ”highly professional Ramping” article!

And what does the ”Market” say to it?

BS shares down 5,91% today….

Brainwash anybody?

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!