MercoPress. South Atlantic News Agency

US government lawsuits against Bank of America related to mortgage-backed securities fraud

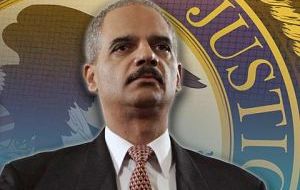

Attorney General Eric Holder said the government wanted “justice for those who have been victimized”.

Attorney General Eric Holder said the government wanted “justice for those who have been victimized”. US government filed two lawsuits against Bank of America relating to fraud on 850 million dollars of mortgage-backed securities. The Justice Department and the Securities and Exchange Commission filed parallel suits in North Carolina.

Attorney General Eric Holder said the government wanted “justice for those who have been victimized”. Bank of America denied the charges, arguing “these were prime mortgages sold to sophisticated investors”

The bank already hinted it expected the suits in a filing last week.

In the Justice Department suit, the government alleged that Bank of America “knowingly and wilfully misled investors about the quality and safety of their investments” in a residential mortgage-backed security known as BOAMS 2008-A.

The security, worth around 850m when it was issued in January 2008, eventually collapsed during the crisis as the quality of the loans contained in it soured. This led to investor losses of more than 100m dollars according to the complaint.

Bank of America says that the fact that the security failed was not the fault of the bank.

“We are not responsible for the housing market collapse that caused mortgage loans to default at unprecedented rates and these securities to lose value as a result,” it argued in a statement.

Bank of America has recently announced a series of settlements, including an 8.5bn settlement with investors dealing with similar mortgage-based securities and a 1.6bn deal with MBIA Inc, a bond insurer.

Top Comments

Disclaimer & comment rules-

-

Read all commentsNo, of course it wasn't their fault everybody who invested in banks using these ridiculous 'investments' as the milk cow lost their money.

Aug 08th, 2013 - 02:48 pm 0It was the tooth fairy that took it.

I took a bath in BoA but Ford bailed me out.

Aug 08th, 2013 - 06:43 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!