MercoPress. South Atlantic News Agency

Number of US jobs created last December was the lowest for three years

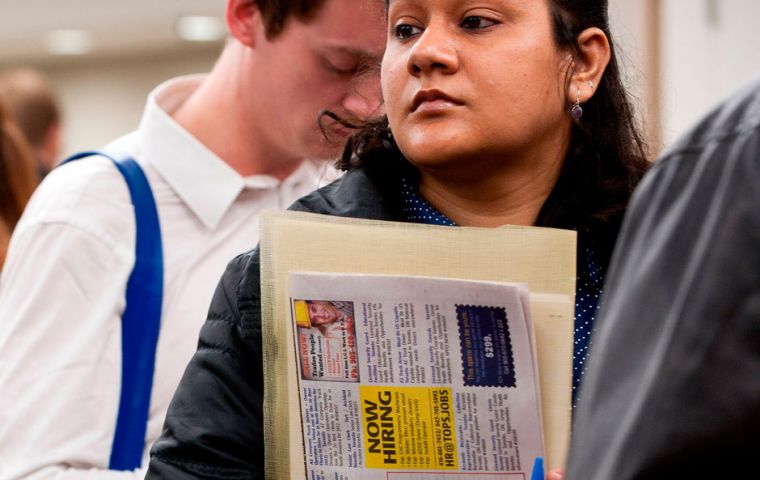

Many Americans have given up looking for jobs, and the climate are seen as the causes

Many Americans have given up looking for jobs, and the climate are seen as the causes The US economy created only 74,000 jobs in December, with many Americans giving up looking for work, latest figures show. The number of jobs created was the lowest for three years and was well under half the number expected by analysts.

The US unemployment rate fell to a five-year low of 6.7%. However, that was mostly due to a drop in the number of Americans looking for work as they became discouraged.

The US had bad weather in December, which may have stalled hiring plans. The labor force participation rate - a closely watched measure - fell noticeably. The share of Americans who are either working or looking is now 62.8%, close to 35-year lows.

The government counts people as unemployed only if they say they are actively searching for work.

The leisure, manufacturing and services sectors added jobs in December, but construction cut 16,000 jobs, the biggest drop in the industry in 20 months.

In the four months before December, the average number of jobs created in the US was 214,000 a month.

Other figures on employment have suggested a healthy jobs market, and the Labor Department said 38,000 more jobs in November were created than the 203,000 previously reported.

Overall, the US economy is picking up steam, with recent figures for consumer spending, trade and factory output all strong. This year, economists expect the US economy to grow by 3%, well up on the 1.7% last year.

The improving picture led the US central bank, the Federal Reserve, to start to taper its massive monetary stimulus program from 85bn a month to 75bn dollars.

If the Fed remains confident about the direction of the economy, it may trim this back further at its next meeting at the end of this month. The meeting will be the last one chaired by Ben Bernanke, who will leave the post after eight years. He will be replaced by Janet Yellen on 1 February.

On Friday, President Obama announced her replacement. The new deputy Fed chairman will be the economist Stanley Fischer, formerly of the World Bank, the IMF and the Israeli central bank.

In related economic news the US trade deficit narrowed to its lowest level in four years in November, as rising sales of oil pushed US exports to a record high. The trade gap dropped by 12.9% to 34.3bn dollars in November, the smallest monthly deficit since October 2009, the US Commerce Department said.

Imports fell 1.4% from October as a fall in demand for foreign oil offset a record level of imported cars. Exports rose 0.9%, boosted by a 5.6% rise in petroleum exports. US exports were also boosted by stronger sales of American-made planes and machinery.

The drop in oil imports was helped by lower global prices. After peaking at 102 dollars per barrel in September, the average price of a barrel of imported crude oil has been falling. It averaged 94.69 a barrel in November.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsAnd this is a surprise?

Jan 11th, 2014 - 09:38 am 0Must be a slow news day.

Your comment makes no sense, Chrissy.

Jan 12th, 2014 - 04:50 pm 0@ 2 Forge Tit 87 or whatever number you are using today.

Jan 12th, 2014 - 09:03 pm 0“Your comment makes no sense, Chrissy.”

Well of course it doesn’t to you, because:

1) You are all angry inside about me and cannot stand it that anything you try to wind me up with blows up in your face, just like this does;

2) You have not bothered to understand why the figures are down. GeofWard42 tells me you are not normally idiotic and as I respect Geoff I take it you just want to have a go at me. Oh dear, when will you ever learn: wasn’t that a song?

3) “Cooking the figures” as the US (and UK) do by removing able bodied labour from the total just because the poor sods can’t find a job. There are NO jobs available, even without the construction nadir;

4) Construction always drops for the nadir months of December, January and most of February simply because pouring concrete is very problematical and antifreeze additives cannot be used in high strength structural construction, therefore it ALL stops;

5) Leisure and the service sectors always add jobs as “it is the season to be merry” and these are usually temporary so can you guess what will happen when these end?

6) The markets are already jittery about the tapering off of the governments titty known as QE and have moved erratically because they are frightened, not just concerned, as to the effect of removing the prop of printing money will mean.

It is to be hoped that the embryonic improvements to the general outlook of the trade deficit in particular holds up, but we shall see.

There, now I have explained it all to you do try to keep up with the rest of us in future.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!