MercoPress. South Atlantic News Agency

Fed shaves another 10bn from stimulus; Turkey and South Africa raise rates

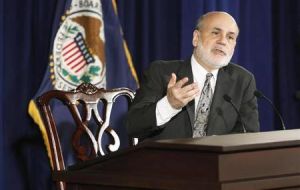

It was chairman Ben Bernanke last meeting, who will be replaced by Janet Yellen (Photo Reuters)

It was chairman Ben Bernanke last meeting, who will be replaced by Janet Yellen (Photo Reuters) The US Federal Reserve announced a $10bn reduction in its monthly bond purchases from 75bn to 65bn in the second straight month of winding down stimulus efforts. The central bank had been buying bonds in an effort to keep interest rates low and stimulate growth.

In a statement the Fed said that “growth in economic activity picked up” since it last met in December. Although the move was expected, US shares still fell on the news.

Information received since FOMC met in December indicates that “growth in economic activity picked up in recent quarters. Labor market indicators were mixed but on balance showed further improvement.

The unemployment rate declined but remains elevated. Household spending and business fixed investment advanced more quickly in recent months, while the recovery in the housing sector slowed somewhat. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable”.

The Fed left its overnight interest rate unchanged at 0% - the level it has been at since December 2008.

Since its last meeting, the central bank said it had seen “improvement in economic activity and labor market conditions... consistent with growing underlying strength in the broader economy”.

The move comes amidst ongoing turmoil in emerging markets, who have been hurt by the prospect of an increase in global interest rates.

Turkey raised its overnight borrowing rate after emergency meetings late on Tuesday to try and combat some investor flight. Likewise South Africa

On Wednesday South Africa's Reserve Bank surprised observers by boosting its main interest rate to 5.5% from 5%. Bank governor, Gill Marcus said “the depreciation of the rand exchange rate” was the primary cause of the rate rise.

She added that the global financial crisis was in a “new phase” and was “creating new challenges for emerging market economies”.

This was the final meeting for outgoing chairman Ben Bernanke, as Janet Yellen is set to take over once he steps down at the end of this week.

For the first time since 2011, the decision to keep slowing down the purchases of long-term bonds was backed by all members of the monetary policy committee.

Despite the fact that most analysts and investors had been expecting the news, the Dow Jones Industrial Average plunged lower after the Fed announcement. By midday, the exchange was down more than 200 points, with the S&P 500 and Nasdaq both trading lower as well.

Investors have been pulling their money out of emerging markets on fears that as the Fed winds down its stimulus efforts, global interest rates could rise. This has led to a global sell off in stocks.

The fear is that fragile emerging economies have been too dependent on low interest rates for too long, and that they might not be able to withstand rising global interest rates in the wake of the Fed's decision.

Some analysts said that while the Fed may not have explicitly mentioned emerging markets in its statement, it would be an oversight to think the central bank isn't keeping a close eye on the global economy.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!