MercoPress. South Atlantic News Agency

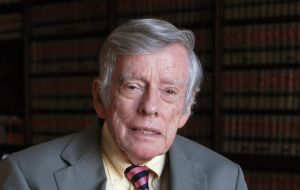

Griesa does not trust Cristina Fernandez and condemns the word “extortionist”

“There is a difference between negotiation and extortion” Cristina Fernandez said after the Supreme Court decision

“There is a difference between negotiation and extortion” Cristina Fernandez said after the Supreme Court decision US Judge Tomas Griesa said on Wednesday that the televised speech delivered by President Cristina Fernández on Monday after the US Supreme Court declined to hear an appeal by Argentina in its battle against the holdouts was “a problem” for negotiations and implied he did not trust the Argentine leader.

“Now that really does not give me confidence in a good faith commitment to pay all the obligations of the Republic” said Judge Griesa in reference to the Monday speech, which he described as “unfortunate”.

“Argentina has shown a more than clear will to pay, but there is a difference between negotiation and extortion” Cristina Fernandez said after the Supreme Court decision.

Responding to a request by NML Capital and other hedge funds that sued Argentina for payment, Griesa lifted a stay, or freeze, on his court order last year for the country to pay up. This refers to the pending payment of 1.3 billion dollars plus interests.

The stay had been in place while the parties waited to see if the Supreme Court would accept Argentina's appeal for it to review the case. But the court turned the appeal back, and by lifting the stay on Wednesday, Griesa started the debt clock ticking.

The New York Judge also criticized the Argentine president speech for saying that creditors were involved are 'extortionists'.

Argentina is scheduled to make debt payments by June 30, to both holders of the restructured debt and now the hedge funds. If it does not pay, a 30-day grace period gives it until the end of July before it will be seen as in default again.

Lawyers for Argentina who met at the court with their hedge funds' counterparts, told the court a team would travel to New York next week to hold talks with the hedge funds.

Robert Cohen, representing NML, said they are “happy to talk”.

But Judge Griesa made clear he was worried new negotiations were just another attempt by Argentina to stall, in a case that dates back more than a decade.

“You can talk about negotiations. But I believe there has to be a legal mechanism to prevent what I'm talking about, because we do not want another charade.”

'What has the Republic done for the last dozen years? It has ignored those judgments, and that is of concern to me.“

Argentina has been fighting NML and other so-called ”holdouts“ for years, after they refused to take part in a restructuring of the nearly 100 billion dollars in debt Argentina defaulted on in 2001.

More than 92% of bondholders took part in the 2005 and 2010 restructurings, in which they took massive write-downs of their bonds' value to help the government rebuild its finances.

But the hedge funds, scooped up the debt on the market at huge discounts when the country fell into default, and have since pursued full payment in courts in New York, where the bonds were issued.

Griesa and Cohen said they wanted more information about Argentina's apparent plan to evade payment on the hedge fund bonds by transferring the restructured or ”exchange“ bonds to Argentine jurisdiction, under Argentine law, via a new bond swap, as apparently was intended by Economy minister Axel Kicillof.

The aim would be to avoid the US court's order that the US banks and settlement agencies which handle the country's debt payments cannot pay the restructured bonds without also paying the holdouts in full.

Griesa clearly warned the banks not to take part in any tactic by Argentina to avoid paying the holdouts.

”There can be no payment to the exchanges (exchange bonds) unless there is a payment to NML. And if anyone undertakes to make a payment to the exchanges, without making sure of a payment to NML, they are in violation of this court order”.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsSo if he does not trust one of the sides in the dispute, isn't that more than enough grounds to legally call into question his imparciality and set up a legal process against the entire process that just ended?

Jun 19th, 2014 - 02:34 am 0News Flash Troll, Nobody, and i do mean nobody trusts Argentina, or the Government of Argentina, or anything about Argentina where money is invovled.

Jun 19th, 2014 - 02:54 am 0Besides, he had to sit there and listen to the testimonies, listen to the rethoric from CFK, One-Eye and Co for years. Listen to all the promises of never yielding to “Vulture Funds” etc etc.

I would sooner trust the devil than anyone from the Argentine Government.

I am sure many would.

Nostrils

Jun 19th, 2014 - 04:34 am 0I

M

P

L

I

E

D

Look up the definition before continuing to make a fool of yourself.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!