MercoPress. South Atlantic News Agency

Griesa appoints mediator for talks between Argentina and holdout hedge funds

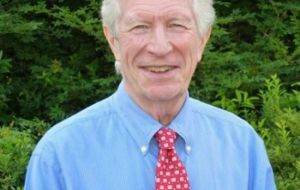

Daniel Pollack was named as “special master to conduct and preside over settlement negotiations”

Daniel Pollack was named as “special master to conduct and preside over settlement negotiations” New York district court judge Thomas Griesa on Monday appointed a Manhattan attorney to supervise talks between Argentina and hedge fund holdout bondholders after the government of President Cristina Fernandez asked him to organize negotiations with its creditors.

The move raised hopes that a deal could be done before a June 30 deadline for Buenos Aires to pay back possibly billions of dollars to creditors, a week after the US Supreme Court turned down the country's last-ditch appeal against bondholders it labels "vultures".

Buenos Aires had warned that the court decision put it in the position of defaulting on its debt for the second time in 13 years.

The news of impending negotiations sent Argentine stocks soaring, with the Merval 25 index adding nearly 9%.

Griesa named Daniel Pollack as "special master to conduct and preside over settlement negotiations" in the case, which pits Argentina against hedge funds who refused to take part in a restructuring of the debt on which Buenos Aires defaulted in 2001.

Pollack is an attorney with the McCarter & English law firm, and specializes in financial litigation.

Griesa's order says that Pollack may conduct talks in public or in private, and that both parties are to offer him their "full cooperation."

Last week, Argentina lost a Supreme Court challenge to a 2012 ruling by Griesa, meaning the country must pay the hedge funds -- "holdouts" from its 2005 and 2010 debt restructuring -- the full value of their bonds at the time it makes its next regular debt payment, scheduled for the end of this month.

While the two funds which sued Argentina in the case, NML Capital and Aurelius Management, hold about 1.3 billion dollars worth of bonds, Argentina says the court decision would force it to pay all holdouts, more than 15 billion, which is more than half of the country's current foreign exchange reserves.

"In this context, we are seeking conditions for negotiation that are just and equitable for 100% of the bondholders," Cristina Fernandez cabinet chief Jorge Capitanich said on Monday.

In addition to asking Griesa to help organize negotiations, economy Minister Axel Kicillof said the country was asking for him to place a stay on implementing the court decision, which would give the talks more time.

Since the June 16 Supreme Court ruling, Buenos Aires has alternately threatened to default on its debt, to negotiate a solution, or to move the legal jurisdiction over its performing, restructured debt from the United States to Argentina, in order to make it possible to service that debt without paying the holdouts.

But Griesa has made clear his decision means the country cannot pay one group without paying the other, and that an attempt to relocate the restructured debt to Argentine jurisdiction is prohibited under his 2012 ruling. He has also threatened banks and financial clearing houses with charges if they take part in any Argentine effort to avoid paying either set of creditors.

Also on Monday, the "American Task Force Argentina", a private group lobbies on behalf of the hedge funds, downplayed claims that enforcing the ruling would necessarily bankrupt Argentina.

"There is no court order to pay 15 billion," said AFTA chairman Robert Shapiro. "It's a number invented by the Argentine government, and which it appears to be using as an excuse to not pay its creditors."

He said they only need -- for the moment -- to pay the 1.3 billion owed to NML and Aurelius, and referred to reports of possible deals with banks that could spread that figure over a longer period.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentstalks, that is what the holdouts propose since years. but with the result of HOW to pay, not IF to pay.

Jun 24th, 2014 - 08:04 am 0bloody args with their delaying tactics.

Every dollar the Argentine govt spends on legal and associated fees on this matter is a dollar that could be more productively used to reduce its debts.

Jun 24th, 2014 - 09:25 am 0Agreed,

Jun 24th, 2014 - 09:31 am 0with all the money wasted of court fees , lawyers fees, expenses ,

they could just as easily paid off a large chunk of it.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!