MercoPress. South Atlantic News Agency

EU holders of restructured Argentine bonds begin court actions in Belgium

Bondholders sent Judge Griesa a request for clarification on the impact of his pari passu (equal treatment) ruling

Bondholders sent Judge Griesa a request for clarification on the impact of his pari passu (equal treatment) ruling  “The trustee has significant concerns regarding the plaintiff’s order to return the funds to Argentina”, said lawyer for New York Mellon bank

“The trustee has significant concerns regarding the plaintiff’s order to return the funds to Argentina”, said lawyer for New York Mellon bank Holders of restructured Argentine bonds took to Belgian courts against Euroclear and the Bank of New York last week over their failure to pay out Argentina’s deposit, newspaper Tiempo Argentino (*) reported, citing court documents signed by the funds’ legal counsel.

“The holders of European bonds have taken legal actions in Belgium against Euroclear and the Bank of New York Mellon Brussels to obtain an order that confirms that the legal mandates (issued in the US) are not applicable in this territory,” the document was reported to read.

The central argument of the creditors demand is that the Belgian Parliament approved a law in 2004 that modified a continental accord, according to which trustees, or banks, cannot be restrained from distributing payments.

“The objective of the Belgian law is to uphold the liquidity of financial markets, guaranteeing freedom from obstructions to payment accounts,” Latham & Watkins elaborated.

“This court can avoid such complications by clarifying that Euroclear, Clearstream, BONY Brussels and BONY Luxembourg are exempt from the application of realm of legal actions, and making it clear that they were not aimed at the processing of Euro-bond payments, which only involve foreign parties, foreign currency and are based outside the US.”

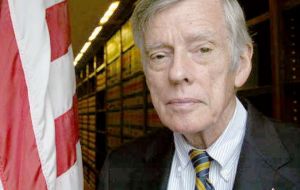

Last Monday, the bondholders had sent Judge Thomas Griesa a request for clarification with regard to the impact of his pari passu (equal treatment) ruling on the repayment of their bonds.

“Lacking jurisdiction over those foreign entities (European banks through which Argentina pays bondholders), this Court should now clarify that they are not subject to the injunctions either directly or by operation,” read the motion drafted by Latham & Watkins, a New York law firm.

Apparently not receiving or waiting for a favorable response from Griesa, the restructured creditors were proactive last week in demanding that the payment made to a BNY Mellon account of the Central Bank in Luxembourg should be sent to a Belgian entity in Frankfurt and finally to investors through clearinghouses in Europe, and payment shouldn’t be disrupted by a ruling based on US jurisdiction.

Following the country’s failed attempt to transfer the funds to pay its bondholders on June 30, the Bank of New York Mellon asked US District Court Judge Griesa on Wednesday to clarify his previous order to return the money since it still holds the 539 million dollars sent by the federal government and fears “litigation risks” if it complies with the magistrate’s ruling.

“The trustee has significant concerns regarding the plaintiff’s order to return the funds to Argentina. Ordering the trustee to do that could expose the trustee to litigation risk particularly outside of the United States,” Eric Schaffer, a lawyer for the bank, said in the letter to Griesa.

Griesa has yet to respond to the Bank of New York.

Restructured creditors’ lawsuit in Europe last week is an example of the litigation Schaffer refers to that could begin to hit banks if they fail to transfer funds deposited by the country, an apparent grey area left by the jurisprudence of Griesa’s ruling.

Knighthead Capital Management (NLY), Redwood Capital Management (RWCB), Perry Capital, VR Global Partners, Monarch Master Funding, Silver Point Capital, QVT Fund, Quintessence Fund, and Centerbridge Partners are among the funds suing Euroclear and BNY Mellon.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsTypical Yankee traits, thinking they are the centre of the universe and the world revolves around the USA....

Jul 08th, 2014 - 09:47 am 0...wait a minute.....it does...

Not sure why they can't send the payment back to Buenos Aires and then Buenos Aires sends it directly to the bond holders.

Jul 08th, 2014 - 12:54 pm 0Screw the old geriatric Judge.

Yep... The USA trying to control the world as usual.

It seems quite simple to me. Judge Griesa issued an order relevant to a bond issuer in NY jurisdiction and its bank, also in NY jurisdiction. Argieland failed to comply with the order by not depositing sufficient funds to cover the required payments. The Bank of New York Mellon Belgian and Luxembourg branches are, I'm sure, perfectly entitled to use their own money to pay the restructured bondholders. Not the Bank of New York Mellon's money. Not the argie government's money. And just a simple question. Where is the money coming from for these legal actions?

Jul 08th, 2014 - 12:59 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!