MercoPress. South Atlantic News Agency

Tag: Euroclear

-

Friday, March 27th 2015 - 08:46 UTC

European clearing houses close trading bridges on Argentine law bonds

Clearing houses Euroclear and Clearstream have closed trading bridges on some 9.4 billion of Argentine bonds issued under the country's law. The action will prevent Euroclear customers from settling their trades with Clearstream clients and vice versa, but will not affect trading between customers belonging to the same clearing company, the same source said.

-

Thursday, March 26th 2015 - 08:22 UTC

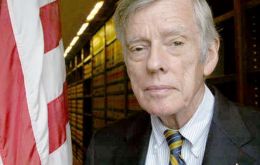

Griesa blocks Euroclear from processing any Argentina bonds payments

New York judge Thomas Griesa on Wednesday barred Euroclear, the giant Belgium-based financial clearing and settlement house, from processing any debt payments by Argentina. In the newest step tightening Buenos Aires' avenues for avoiding paying off hedge funds on their bonds, Griesa forbade Euroclear from processing “any payments received from any source” in respect to Argentine bonds.

-

Tuesday, July 8th 2014 - 08:33 UTC

EU holders of restructured Argentine bonds begin court actions in Belgium

Holders of restructured Argentine bonds took to Belgian courts against Euroclear and the Bank of New York last week over their failure to pay out Argentina’s deposit, newspaper Tiempo Argentino (*) reported, citing court documents signed by the funds’ legal counsel.