MercoPress. South Atlantic News Agency

Aurelius Capital confirms no deal with banks on Argentina's bonds

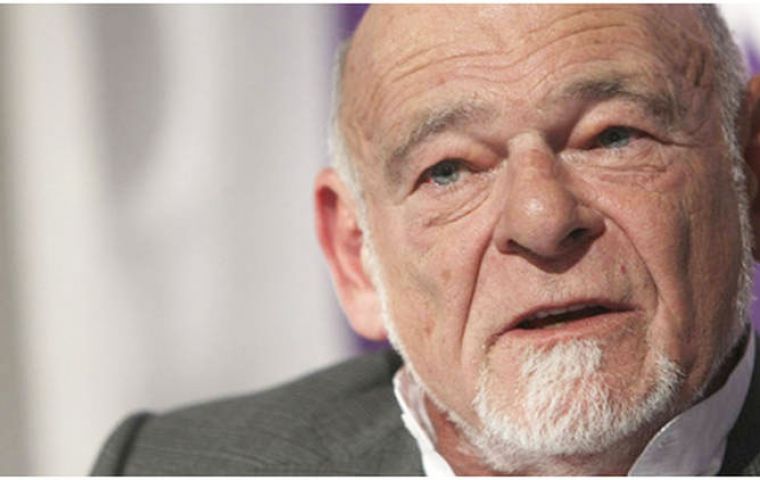

“Argentine officials made a cynical and cold decision in letting the country default, the worst is yet to come”, said Mark Brodsky from Aurelius

“Argentine officials made a cynical and cold decision in letting the country default, the worst is yet to come”, said Mark Brodsky from Aurelius Argentine holdout creditor Aurelius Capital Management has said that after talks with many financial institutions, the prospects for finding a private-settlement solution to the Argentine sovereign debt dispute had garnered no realistic proposals.

“That engagement has convinced us that there is no realistic prospect of a private solution,” Aurelius said in a statement.

“No proposal we received was remotely acceptable. The entities making such proposals were not prepared to fund more than a small part, if any, of the payments they wanted us to accept. One proposal was withdrawn before we could even respond. And no proposal made by us received a productive response,” the statement reads.

Aurelius, run by Mark Brodsky, former Elliott Management Corp, said Argentine officials made a “cynical and cold decision” in letting the country default and warned “the worst is yet to come.”

”Argentine officials hide behind the RUFO provision but make no effort to seek waivers from it (despite being offered them by many of the exchange bondholders). The Argentine people have already paid a dear price for their leaders' hubris,” the statement concludes.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsComment removed by the editor.

Aug 14th, 2014 - 07:16 am 0Comment removed by the editor.

Aug 14th, 2014 - 07:30 am 0Instead of giving us the impression that you are blameless in these negotiations,,,why not give details of what deals you have been turning down....

Aug 14th, 2014 - 09:53 am 0So 80 cents on the dollar was not acceptable...what is an acceptable deal...

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!