MercoPress. South Atlantic News Agency

Tag: Elliot Management fund

-

Wednesday, April 27th 2016 - 10:44 UTC

Paul Singer praises Macri but warns about negative impact from Collective Action Clauses

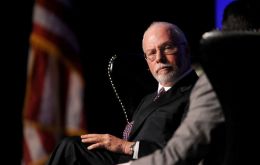

Financier Paul Singer again took to the US media to celebrate Argentine President Mauricio Macri’s decision to settle with the so-called “speculative” creditors, including Singer’s own Elliott Management, with an article in the Wall Street Journal heaping praise on his business-friendly approach and willingness to negotiate with the holdouts.

-

Friday, April 22nd 2016 - 07:48 UTC

Singer praises Macri and calls him a great 'reformist' in a Time weekly column

United States hedge fund billionaire Paul Singer is a big fan of Argentina’s new president. For one thing, Mauricio Macri doesn’t call him a “vulture lord” or a “bloodsucker,” as his predecessor Cristina Fernández did. More important, the newly elected Macri recently paid Singer’s firm US$2.28 billion in debt.

-

Tuesday, April 19th 2016 - 08:47 UTC

Spectacular Argentine return to money markets: bond issue subscribed several times

Argentina marked a spectacular comeback to world money markets on Monday when its first bond issue in fifteen years attracted bids more than three times reaching US$ 67 billion. Argentina is after US$ 15bn which will help pay creditors on its ongoing litigation, since the country defaulted back in 2001.

-

Monday, April 18th 2016 - 08:49 UTC

Argentina returns to money market for US$ 15bn to pay bondholders

Once Argentina pays the holdout funds, US District Judge Thomas Griesa will lift the injunctions against the country, court-appointed mediator Daniel Pollack said, following the appeals court ruling that cleared the way for Argentina to pay its debts.

-

Saturday, April 2nd 2016 - 07:04 UTC

How hedge funds held Argentina for ransom

By Martin Guzman and Joseph E. Stiglitz (*) - Perhaps the most complex trial in history between a sovereign nation, Argentina, and its bondholders — including a group of United States-based hedge funds — officially came to an end yesterday (March 31) when the Argentine Senate ratified a settlement.

-

Friday, March 4th 2016 - 07:02 UTC

Paul Singer will have made a $2.4bn profit with the Argentine defaulted bonds

Elliott Management Corp., a New York-based hedge fund that invested in distressed Argentine government bonds well over a decade ago, will have made a $2.4 billion profit on its wager once this week's settlement is finalized, the Wall Street Journal said.

-

Tuesday, March 1st 2016 - 05:05 UTC

Special Master announces settlement of 15-year battle between Argentina and 'holdout' hedge funds

Daniel A. Pollack, Special Master appointed to preside over settlement negotiations between the Republic of Argentina and its “Holdout” Bondholders, this morning (29 February) issued the following statement:

-

Thursday, February 25th 2016 - 06:16 UTC

Argentina in pre-accord with toughest hedge funds; Special Master Pollack furious

Argentina and a group of hedge funds are nearing a deal that would pay investors about 70% of what they say they are owed, as the government moves closer to re-entering the global bond markets following its 2001 default.

-

Saturday, February 13th 2016 - 05:40 UTC

Aurelius hedge fund “baffled” by Argentina's decision to 'continue litigation'

Hedge fund Aurelius Capital Management, one of the major creditors in the Argentine bond litigation who has not agreed to participate in a proposed $6.5 billion settlement, called Argentina's decision to return to court in the dispute “baffling.”

-

Wednesday, February 10th 2016 - 07:24 UTC

Argentina still has uphill battle with holdouts: a stay of pari-passu is next round

While investors cheered progress on last week's arduous negotiations in New York between Argentine government officials and litigant investors, the administration of president Mauricio Macri still faces an uphill battle as it works to bring other holdouts on board.