MercoPress. South Atlantic News Agency

Special Master announces settlement of 15-year battle between Argentina and 'holdout' hedge funds

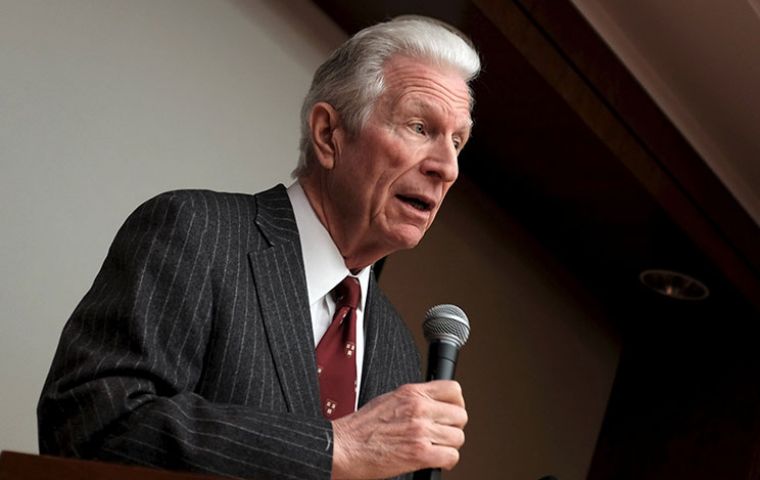

Pollack 'expressed greatest pleasure' in announcing that the 15-year pitched battle between Argentina and Elliott Management is now on its way to being resolved.

Pollack 'expressed greatest pleasure' in announcing that the 15-year pitched battle between Argentina and Elliott Management is now on its way to being resolved.  The Special Master praised 'foremost' the Hon. Thomas P. Griesa, the Federal Judge who presided over all cases in re Argentina Debt Litigation for 15 years.

The Special Master praised 'foremost' the Hon. Thomas P. Griesa, the Federal Judge who presided over all cases in re Argentina Debt Litigation for 15 years.  Entitled to greatest credit are President Macri, who immediately upon his election in November, set about to change the negative course steered in this litigation

Entitled to greatest credit are President Macri, who immediately upon his election in November, set about to change the negative course steered in this litigation  Secretary of Finance Caputo led the delegation that met with Pollack and with “holdout” bondholders for countless hours, with patience, good will and intelligence.

Secretary of Finance Caputo led the delegation that met with Pollack and with “holdout” bondholders for countless hours, with patience, good will and intelligence.  On the “holdout” hedge fund side, Paul E. Singer was the central figure who involved intensely over the past several weeks on behalf of the “holdouts”

On the “holdout” hedge fund side, Paul E. Singer was the central figure who involved intensely over the past several weeks on behalf of the “holdouts” Daniel A. Pollack, Special Master appointed to preside over settlement negotiations between the Republic of Argentina and its “Holdout” Bondholders, this morning (29 February) issued the following statement:

“It gives me greatest pleasure to announce that the 15-year pitched battle between the Republic of Argentina and Elliott Management, led by Paul E. Singer, is now well on its way to being resolved. The parties last night signed an Agreement in Principle after three months of intense, around-the-clock negotiations under my supervision. The Agreement in Principle, if consummated, will pay NML Capital Ltd, the fund managed by Elliott, and several other funds of other managers who had sued alongside NML, the aggregate sum of approximately $4.653 billion dollars to settle all claims, both in the Southern District of New York and world-wide. This is a giant step forward in this long-running litigation, but not the final step.

The Agreement in Principle is subject to approval by the Congress of Argentina and, specifically, the lifting of the Lock Law and the Sovereign Payment Law, enacted under an earlier Administration and which would bar such settlements. Thereafter, Argentina contemplates a capital-raise in the global financial markets, which would be used to fund the payments. The four “holdout” Bondholders who are signatories to this Agreement in Principle, have agreed not to attempt to attach or otherwise interfere with that capital-raise. Upon payment, the Injunctions entered several years ago against Argentina by Judge Thomas P. Griesa would automatically dissolve if Judge Griesa’s Indicative Ruling of February 19 is converted into a final Order vacating the Injunctions.

The parties have agreed to take all steps necessary to cooperate with me in my capacity as Special Master and with each other to effect a consummation of the Agreement in Principle and a termination of the litigation. It is hoped by the parties that all necessary steps can be taken in a period of six weeks. The Agreement in Principle, if consummated, will pay the Funds managed by Elliott Management, Aurelius Capital, Davidson Kempner and Bracebridge Capital, 75% of their full judgments including principal and interest, plus a payment to settle claims outside the Southern District of New York and certain legal fees and expenses incurred by them over a 15-year period.

There are many people who have devoted untold hours or special talents, or both, to making this settlement possible. Foremost among them is Hon. Thomas P. Griesa, the Federal Judge who presided over all cases in re Argentina Debt Litigation for 15 years. Others entitled to greatest credit are President Mauricio Macri of Argentina, who immediately upon his election in November, set about to change the negative course that the Republic had steered in this litigation, and his Secretary of Finance Luis Caputo, who led the delegation that met with me in my capacity as Special Master and with the “holdout” Bondholders for countless hours, with patience, good will and intelligence. He was ably assisted by Santiago Bausili, Under Secretary of Finance. Also involved as important decision-makers for Argentina were: Alfonso Prat-Gay, Minister of the Economy, and Marcos Peña and Mario Quintana, the Chief and Vice Chief of the Cabinet. Their course-correction for Argentina was nothing short of heroic.

On the “holdout” hedge fund side, Paul E. Singer was the central figure who involved himself intensely with me over the past several weeks on behalf of the “holdout” Bondholders. He was a tough but fair negotiator. His second-in-command, Jon Pollock, also made a key contribution to the success of the negotiations. All of the senior principals of the “holdout” hedge funds demonstrated vast talent. No party to a settlement gets everything it seeks. A settlement is, by definition, a compromise and, fortunately, both sides to this epic dispute finally saw the need to compromise, and have done so.

This settlement, if consummated, together with prior Agreements in Principle with other “holdout” Bondholders, resolves over 85% of the claims of those with “pari passu” and “me-too” Injunctions. I will continue to serve, at the pleasure of Judge Griesa, until all claims are resolved, both with respect to the consummation of this central Agreement in Principle and to facilitate settlement with all other “holdout” Bondholders who wish to resolve their claims with Argentina. In short, I will continue to help the willing find solutions.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsLaughing so hard right now!

Mar 01st, 2016 - 08:18 am 0All Yankeeboy's predictions regarding this and Singer still took a haircut.

Well glad it's over. Argentina hasn't 'collapsed'.

At last.

Mar 01st, 2016 - 10:32 am 0Maybe...just maybe, we are becoming adults who can´t rant and whine and go around accusing the rest of the world as responsible for all our self-caused troubles.

If only the same approach was made towards the Falklands ... we would get a ticket to get back to the world.

I´ll hold my breath a little more.

@2

Mar 01st, 2016 - 01:14 pm 0Why?

Only the Anglo has the right to the above attitude? They do it all the time.

“It's the immigrants fault!”

“It's the Arabs fault!”

“It's the Jews fault!”

“It's the EU's fault!”

“It's Mexico's fault!”

“It's the Chinese fault!”

“It's the Russians fault!”

“It's the Germans fault!”

“It's the French fault!”

“It's the Pakis fault!”

Why can they do it and we can't?

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!