MercoPress. South Atlantic News Agency

Argentina appeals to Judge Griesa bar on Citibank to process bonds under local law

Griesa said Argentina can’t pay holders of the performing debt without also paying Paul Singer’s NML Capital that’s owed 1.7bn dollars on defaulted bonds.

Griesa said Argentina can’t pay holders of the performing debt without also paying Paul Singer’s NML Capital that’s owed 1.7bn dollars on defaulted bonds. Argentina has formally appealed to the New York justice system the ruling handed down by district judge Thomas Griesa, which barred intermediary Citibank from processing US dollar denominated debt services issued under Argentine law and which expired on March 31.

President Cristina Fernández administration argued that the dollar-linked bonds under Argentine law “are not external debt, but internal, and therefore cannot be reached by Judge Griesa's ruling.”

The decision by the government to appeal coincides with Citibank dropping their own petition against the judgment after agreeing a deal with holdout investors. That move led to the suspension of local CEO Gabriel Ribisch, after Argentine held that the pact was illegal.

Citibank argued that a 2012 ruling blocking Argentina from paying holders of its performing debt didn’t apply to it. Failure to make the payment would force the bank to violate Argentine law and endanger its ability to do business in the country, Citibank said.

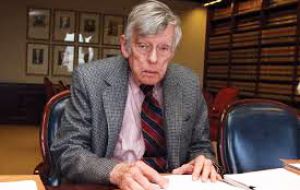

U.S. District Judge Thomas Griesa rejected the arguments, ruling U.S. dollar-denominated bonds issued in Argentina under that country’s law are covered by the 2012 ban. In the 2012 ruling, Griesa said Argentina can’t pay holders of the performing debt without also paying a group led by Paul Singer’s NML Capital that’s owed 1.7bn dollars on the country’s defaulted bonds.

The case is NML Capital Ltd. v. Republic of Argentina, 08-cv-6978, U.S. District Court, Southern District of New York.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsChrtist, how many appeals is this? Just pay and move on, you only lose face or is that too hard to accept?

Apr 07th, 2015 - 08:28 am 0Golfie... We all know the ploy.... Defer and delay ... And hope it goes away...

Apr 07th, 2015 - 12:46 pm 0It rings out a little no?

Anyway a famous (infamous!!) man once said that if you perpetuate the lie long enough eventually it will be considered a truth...

I believe it was the NAZI Goering .... Cretina and Knobby probably use that as their daily mantra....

They should be HDAQ' ..... Limpdick also!!

It's an iceberg and Singer is only the tip. If they pay the 1.7B it will embolden everyone else. They are very afraid that universal acceleration and repudiation by the bondholder class will put them out in the street.

Apr 07th, 2015 - 12:49 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!