MercoPress. South Atlantic News Agency

Appeals court hands victory to Argentina in bonds dispute; questions Judge Griesa's 'class' expansion

Judge Wesley noted that defining a precise class to which Argentina owes damages and calculating those damages have been “exasperating tasks.”

Judge Wesley noted that defining a precise class to which Argentina owes damages and calculating those damages have been “exasperating tasks.”  “Ruling makes clear that plaintiffs may not use the class mechanism to avoid having to prove the actual damages of purported class members,” Boccuzzi said

“Ruling makes clear that plaintiffs may not use the class mechanism to avoid having to prove the actual damages of purported class members,” Boccuzzi said  U.S. District Judge Thomas Griesa's regular rulings in favor those bondholders have made him deeply unpopular in Buenos Aires.

U.S. District Judge Thomas Griesa's regular rulings in favor those bondholders have made him deeply unpopular in Buenos Aires. A United States federal appeals court handed Argentina a victory Wednesday in its quest to relieve itself of the pressures of debt owed to American hedge funds and others, saying a judge went too far by letting some bondholders demand payment without proving how much they are entitled to be paid.

The 2nd U.S. Circuit Court of Appeals said a lower-court judge was oversimplifying the definition of the class of bond holders affected by his orders.

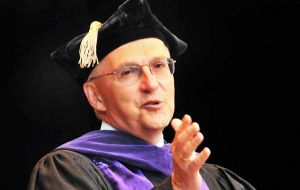

A ruling written by Circuit Judge Richard Wesley noted that defining a precise class to which Argentina owes damages for refusing to pay bondholders and calculating those damages have been “exasperating tasks.”

But the decision issued by a three-judge panel said Judge Thomas P. Griesa was making it too easy for some plaintiffs by creating a class including bondholders who were not the original purchasers of the bonds.

“While objective criteria may be necessary to define an ascertainable class, it cannot be the case that any objective criterion will do,” Wesley wrote. “A class defined as 'those wearing blue shirts,' while objective, could hardly be called sufficiently definite and readily identifiable; it has no limitation on time or context, and the ever-changing composition of the membership would make determining the identity of those wearing blue shirts impossible.”

In expanding the definition of a bondholder class last year, Griesa contradicted earlier instructions that the Second Circuit gave him to hold an evidentiary hearing regarding the size of the class and amount of damages, according to the ruling.

Argentina has long been embroiled in litigation in the United States over its failure to pay for more than $80 billion in sovereign debt stacked up from its 14-year-old financial crisis.

When Argentina hammered out two restructuring deals in 2005 and 2010 that satisfied roughly 91% of bondholders, remaining bondholders filed a flurry of lawsuits.

U.S. District Judge Thomas Griesa's regular rulings in favor those bondholders have made him deeply unpopular in Buenos Aires.

Carmine Boccuzzi, an attorney for Argentina with the firm Cleary Gottlieb Steen & Hamilton said that he was “very pleased” with the court's opinion.

“The ruling makes clear that plaintiffs may not use the class mechanism to avoid having to prove the actual damages of purported class members,” Boccuzzi said in an email.

In court papers, Boccuzzi wrote that judgments in favor of members of the class were “inflated and inaccurate” because the bonds at stake are regularly traded in the secondary market.

Henry H. Brecher is the lead plaintiff suing Argentina. His attorney, Jason Zweig with Hagens Berman Sobol Shapiro, did not return a request for comment.

However in court papers, Zweig wrote dismissively of Argentina's arguments, saying the appeal was designed “simply to further delay this already 9-year-old case, in order to prolong the day it must pay its outstanding debts.”

Wesley's ruling follows two significant legal victories for Argentina that other panels of the same court handed down last month.

On Aug. 10, the appellate court overturned Griesa's definitions of a bondholder class in Puricelli vs Argentina.

Weeks later, the appellate court ruled Argentina's central bank had immunity from legal action by hedge funds owned by Republican billionaire Paul Singer, whose financial institutions are denounced by Argentina as “vulture funds” for buying Argentina's distressed debt for pennies on the dollar during the economic crisis and then demanding the full value.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsThis won't make any real difference, the liars and crooks of TMBOA will spin it out until the new government takes over who will have to pay the actual debts owed to bondholders if TDC wants to access credit in the world markets.

Sep 17th, 2015 - 11:17 am 0A step in the right direction for the judges, who are reigning in some of the most blatant excesses of a judge bent on inflicting as much damage as he possibly can to a country that refuses to kneel down.

Sep 17th, 2015 - 04:16 pm 0As usual, diligent ChrisR hurries up to reassure us that “this won't make any real difference.”

He makes as much sense as CFK's political opposition: “If we win, all is right. If we lose, we'll claim fraud.”

Well I for one am shocked. lol.

Sep 17th, 2015 - 07:47 pm 0Wheel him off.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!