MercoPress. South Atlantic News Agency

Argentina: Holdouts dispute, a Cristina Fernandez legacy for the next government

Griesa said he assumed Argentina's refusal to negotiate “at this late date in this very lengthy litigation that attitude is over with”

Griesa said he assumed Argentina's refusal to negotiate “at this late date in this very lengthy litigation that attitude is over with”  Robert Cohen, NML Capital lawyer, argued that expanding the amount of debt subject to injunction would be a “plus not a minus” in facilitating a settlement.

Robert Cohen, NML Capital lawyer, argued that expanding the amount of debt subject to injunction would be a “plus not a minus” in facilitating a settlement.  Carmine Boccuzzi, Argentina's lawyer, countered that this would complicate a settlement by expanding the number of holdouts with “veto power” over a deal.

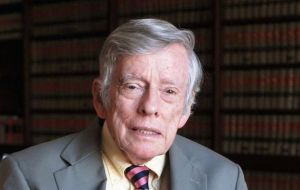

Carmine Boccuzzi, Argentina's lawyer, countered that this would complicate a settlement by expanding the number of holdouts with “veto power” over a deal. US District Judge Thomas Griesa of New York on Wednesday urged Argentina to resume talks to settle bondholder litigation flowing from its $100 billion default in 2002. The judge made the remarks as creditors suing over defaulted bonds urged him to expand to nearly $8 billion the amount Argentina must pay them to service its restructured debts.

Griesa however made no reference to Sunday's election to replace Argentine President Cristina Fernandez, whose administration has called the suing creditors “vultures”. The election faces a run off next 22 November between the two most voted candidates.

The judge noted Argentina previously declined to participate in settlement negotiations and said he assumed “at this late date in this very lengthy litigation that attitude is over with” and insisted “the way to ultimately resolve this litigation must come through settlement”.

The comments came during the latest hearing litigation by creditors seeking full repayment on Argentine bonds following the country's 2002 default. The holdouts spurned Argentina's 2005 and 2010 debt restructurings, which resulted in 92% of its defaulted debt being swapped and investors being paid less than 30 cents on the dollar.

Wednesday's hearing concerned whether Griesa should order Argentina to pay 530 creditors seeking $6.15 billion when it services its restructured debt. Those creditors were seeking the same treatment as several hedge funds Argentina was ordered to pay $1.33 billion plus interest. They are identified as the 'me too'.

The decision, which the U.S. Supreme Court declined to review, pushed Argentina into default again in July 2014 after it refused to honor Griesa's orders and failed to settle with the holdouts, who with interest are now owed $1.76 billion.

Robert Cohen, a lawyer for Elliott Management's NML Capital Ltd, a lead holdout, argued on Wednesday that expanding the amount of debt subject to an injunction would be a “plus not a minus” in facilitating a settlement.

Carmine Boccuzzi, Argentina's lawyer, countered that doing so would complicate settlement talks by expanding the number of holdouts with “veto power” over a deal.

The hearing came after Sunday's presidential election in Argentina to determine who would succeed Fernandez ended with a strong showing from a pro-business opposition candidate. Cristina Fernandez is schedule to step down on 10 December, and until then the Argentine position remains unmovable.

Griesa, holdouts and the 'me too', will have to wait for the new government to see what chances of an agreement are possible, if any.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsTMBOA will NEVER settle with the so called “vultures” and even if by some miracle she changed her mind there is no money to pay them and no way international markets are going to touch The Dark Country, nevermind 'loan' them money which they will never pay back.

Oct 29th, 2015 - 11:14 am 0“Carmine Boccuzzi, Argentina's lawyer, countered that doing so would complicate settlement talks by expanding the number of holdouts with “veto power” over a deal.”

Oct 29th, 2015 - 11:38 am 0What settlement talks ?

Actually, if the “Me too”ers are included this is bad news for the hedge funds. As and when (if ever) there are settlement talks, there will be finite resources to offer in settlement. The larger the number of claimants who have to be satisfied, the lesser the amount each one will get. Because of this, Argentina's best strategy from the outset has been to increase the number of claimants to priority treatment as much as possible, or at least to threaten to do so. The more diluted their claim becomes, the more anxious the hedge funds will be to settle, This has always been the weakness of their position. Curiously, the Argentines have ignored it so far, presumably because the larger that group becomes the weaker the Argentines will appear to be. While I am not familiar with the documentation I feel there must be something they could do that would effectively put all claimholders on the same level. I would not want to be an investor in one of the hedge funds if that were to happen. Still, I suppose the hedge funds are counting on the Argentines not being able to figure this out.

Of course both the Argentine economy and the Argentine reputation are now so destroyed that whether they ever regain access to international financial markets becomes a moot point.

@2. Where do “finite resources” come into the picture? Take a look at the number of capital and infrastructure projects that argieland has started. Take the supposed acquisition of the CAC/PAC JF-17 Thunder. It doesn't matter how much, if anything, argieland pays for them. The Block 2 machines are valued at US$28 million each. Argieland is on for 20. Take possession and sell them for US$14 million. That's US$280 million for a start. How about the 5 Type 056/P18 corvettes? Costing US$50 million each. Sell at half price. That's another US$125 million. Maybe they could be sold at cost? Take possession of argie nuclear power stations. Even better, take possession of the banks. I'm sure that Judge Griesa is prepared for anything argieland could do. Aren't the “me too”s already on the same level? Wasn't that the whole idea? That they should be treated the same as the hedge funds.

Oct 29th, 2015 - 12:30 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!