MercoPress. South Atlantic News Agency

Argentina's financial agenda: talks with holdout funds and farmers' dollars

Finance Secretary Caputo will travel to New York and meet with court-appointed mediator Daniel Pollack and representatives from the so-called holdout funds.

Finance Secretary Caputo will travel to New York and meet with court-appointed mediator Daniel Pollack and representatives from the so-called holdout funds.  A stay from the US judge Griesa would allow Argentina to issue debt under New York legislation and not face any attempts by the funds to block or seize the debt

A stay from the US judge Griesa would allow Argentina to issue debt under New York legislation and not face any attempts by the funds to block or seize the debt  “Solicitors Cleary were part of the reason of the failure of the negotiations. We want to solve the issue as soon as possible” Prat-Gay said at a recent conference.

“Solicitors Cleary were part of the reason of the failure of the negotiations. We want to solve the issue as soon as possible” Prat-Gay said at a recent conference.  Farmers are expected to sell hoarded cereals at a weekly rate of 400 million dollars. So far it has been 250m

Farmers are expected to sell hoarded cereals at a weekly rate of 400 million dollars. So far it has been 250m A challenging financial week takes off for Argentina's new administration of president Mauricio Macri: on the one hand Argentine farmers have to keep their part of the deal by providing the central bank with 400 million dollars a week, and on the other the long-awaited debt talks are expected to resume in New York next Wednesday with United States hedge funds suing Argentina over defaulted sovereign bonds.

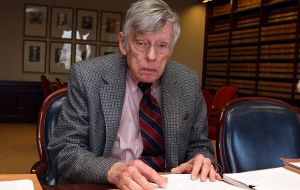

Finance Secretary Luis Caputo will travel to New York and meet with court-appointed mediator Daniel Pollack and representatives from the so-called holdout or “vulture” funds.

The talks would mark a major breakthrough in the dispute, which has kept Argentina largely shut out of international capital markets. President Macri’s administration has long said that settling the debt issue with the holdout bondholders would be a priority for his administration as it is the key to boosting economic growth.

Caputo already travelled twice to New York since Macri’s presidential victory on November 22 to meet with Pollack and discuss the upcoming negotiations. The court-appointed mediator described the meetings as “constructive,” and said “substantive negotiations” between the holdouts and the government would begin in early January.

The Argentine government will probably try to come to an agreement on a hair cut to lower the bill with holdouts that is currently of around US$8 billion, a figure reached in October after United States District Judge Thomas Griesa agreed that holders of US$6.1 billion of defaulted bonds must also receive payment when the country services restructured debt.

The figure adds up to the US$1.33 billion, plus interest, granted initially to NML and Aurelius, the main holdout funds behind the litigation against Argentina.

At the same time, Macri’s envoy will likely say that as a condition for the talks to take place there must be a temporary stay on current court rulings to allow the country to pay its performing debt — the one issued after the default — without the risk of any embargoes in the United States.

A stay from the US judge Griesa would also allow the government to issue debt under New York legislation and not face any attempts by the funds to block or seize the debt payments. Issuing debt under New York legislation would allow the country to pay a much lower interest rate than the approximately nine percent achieved during the last debt issuance.

As the talks near, the government is looking for a new law firm to represent the country in the negotiations. The current lawyers at Cleary, Gottlieb, Steen & Hamilton will have to work alongside another firm as Finance Minister Alfonso Prat-Gay has said the country’s lawyers are at least in part to blame for failing to reach a deal. Several candidates are on the list of potential law firms, such as Shearman & Sterling and Watchel-Lipton.

“Cleary was part of the reason of the failure of the negotiations. We want to solve the issue as soon as possible, there are investors from Europe also waiting for a solution” Prat-Gay said at a recent press conference.

The other front facing Prat-Gay is that of farmers hoarding crops, which are estimated to total some 8 billion dollars. The original agreement was for the farmers to begin selling grains and oil seeds, now that export duties have been dropped or decreased, but so far the rate has been in the range of 250 million a week instead of the 400 million. To this must be added the fact that dollar has been allowed to float in a reasonably free manner, in the range of 13/14 Pesos to the dollar an additional incentive for farmers.

Last Friday the Argentine Central Bank foreign-currency reserves dropped US$113 million and closed at US$25.556 billion, returning to a negative trend but accumulating US$45 million in the week. The monetary authority didn’t intervene in the market, which saw a larger demand than supply of foreign currency.

Top Comments

Disclaimer & comment rules-

-

-

Read all comments“Cleary was part of the reason of the failure of the negotiations. We want to solve the issue as soon as possible, there are investors from Europe also waiting for a solution” +++

Jan 11th, 2016 - 02:32 pm 0that is a light on the horizon.

US$15 billion. No stays. No bonds. Cash. US$100 bills. argieland is used to this method of moving money. How many attache cases is that? Argieland has US$25.556 billion in “reserves”. Anybody care if argieland's ”reserves are reduced to US$10 billion. For how many years has argieland evaded payment? It deserves to suffer.

Jan 11th, 2016 - 03:22 pm 0Good luck on a stay on existing rulings!

Jan 11th, 2016 - 05:50 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!