MercoPress. South Atlantic News Agency

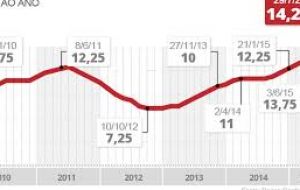

In a surprise move, Brazil's central bank leaves interest rate unchanged at 14.25%

Chief Alexandre Tombini and five other members of the monetary policy committee voted to hold the rate steady, while two voted to increase it.

Chief Alexandre Tombini and five other members of the monetary policy committee voted to hold the rate steady, while two voted to increase it.  Surprising some observers, the central bank left the benchmark Selic rate at 14.25%, citing “increased domestic and particularly external uncertainties.”

Surprising some observers, the central bank left the benchmark Selic rate at 14.25%, citing “increased domestic and particularly external uncertainties.”  The bank has been in a bind, since raising the rate risks further dampening economic activity just as fresh data point to a deep recession this year.

The bank has been in a bind, since raising the rate risks further dampening economic activity just as fresh data point to a deep recession this year. Recession-hit Brazil's central bank in a divided vote left the key interest rate untouched on Wednesday despite rising inflation, opting against an increase that could put a further brake on the world's seventh-biggest economy.

Surprising some observers, the bank left the benchmark Selic rate at 14.25%, citing “increased domestic and particularly external uncertainties.”

It said central bank chief Alexandre Tombini and five other members of the monetary policy committee had voted to hold the rate steady, while two voted to increase it.

Officials are under pressure to ease the hardship of ordinary Brazilians squeezed by rising prices with double-digit inflation. But the bank has been in a bind, since raising the rate risks further dampening economic activity just as fresh data point to a deep recession this year.

The rate has now been steady since July 2015, when the bank made the last of seven consecutive hikes to try to put a lid on inflation.

Battered by economic and political turbulence as it prepares to host this year's Olympic Games, Brazil recorded its highest inflation rate in 13 years at the close of 2015, at 10.67%, well above the central bank's target ceiling of 6.5%.

That rapid rate in the rise of prices for everyday goods sharpens Brazilians' economic woes after the country fell into recession in the second quarter of last year.

The International Monetary Fund said on Tuesday it expected Brazil's economy to contract 3.5% this year, a much darker outlook than its previous forecast of 1% fall. IMF also cut its forecast for the world economy as a whole, saying that risks in the major emerging economies were weighing down growth.

The Fund warned the strong US dollar, collapsed oil prices and political turmoil could all cause further havoc in struggling economies like Brazil's and Russia's.

Brazil's economy shrank by 3.8% in 2015. The country is suffering rising unemployment and a drop in investor confidence fueled by impeachment proceedings against populist President Dilma Rousseff and a major scandal at state oil firm Petrobras.

The Copom release stated that assessing the macroeconomic scenario, prospects for inflation, and the current balance of risks and considering the increase in domestic, and particularly external uncertainties, Copom decided to keep the Selic rate unchanged at 14.25%, with six votes supporting and two favoring an increase of 0.50 percentage points.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsMy guess is that interest rates will begin to download to support investments directed to export, infrastructure and construction. Intensive activities that generate demand for labor.

Jan 21st, 2016 - 10:08 am 0The Labour government should lower interest rates to a minimum of 4% pa and cover any cash withdrawals invested in treasury bonds with our foreign exchange reserves in dollars.

In my forecast interest in this 4% level they gave Brazil a nominal surplus 10% of GDP per year. What would give the Brazilian government a great power of investment.

https://www.youtube.com/watch?v=oxYnhkP9SQY&list=FLmXPTu1f8AdGlizWNiASx2A

Brazil is worse than anyone has been predicting ( except me of course :)

Jan 21st, 2016 - 01:08 pm 0Anyhoo expect the Rial to go to 6/1 and inflation to top 20%

Then its all over

They'll never get inflation down

it will spiral out of control

and Brazilian companies will go bankrupt one after the other trying to pay back their U$ denominated loans

Brazil doesn't have near enough reserves to fix this problem

They'll start burning through them regardless

Their won decade looks a lot like Argentina's won decade

All propaganda with no substance

They have too many poor uneducated people to ever make it out of being a 3rd world sh*thole.

The only surprise to me is that they still have a Central Bank!

Jan 21st, 2016 - 02:09 pm 0Dropping the interest rate to half what it is would encourage the economy and promote employment but it will never happen.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!