MercoPress. South Atlantic News Agency

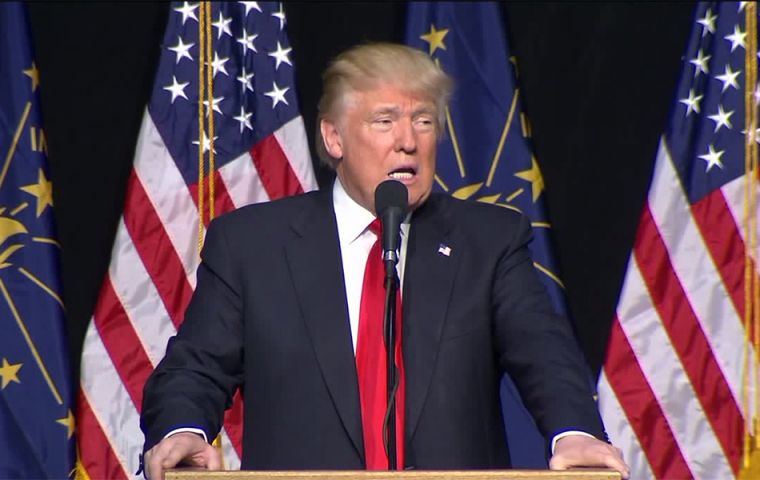

Trump announces a “once in a generation” sweeping tax reform

“This is a once-in-a-generation opportunity, and I guess it’s probably something I can say that I’m very good at. I’ve been waiting for this for a long time”.

“This is a once-in-a-generation opportunity, and I guess it’s probably something I can say that I’m very good at. I’ve been waiting for this for a long time”. United States President Donald Trump has unveiled sweeping tax reforms which if passed by the Congress would bring down the business tax rate to 15%, introduce territorial tax system that would offer level playing field to American companies.

Aimed at targeting the middle-class families, which constitutes the core of nation’s vote bank, Trump has proposed to reduce the current seven tax brackets to just three of 10, 25 and 35%; double the standard deductions and provide relief for families with child and dependent care expenses.

“This is a once-in-a-generation opportunity, and I guess it’s probably something I can say that I’m very good at. I’ve been waiting for this for a long time.

“We’re going to cut taxes for the middle class, make the tax code simpler and more fair for everyday Americans, and we are going to bring back the jobs and wealth that have left our country — and most people thought left our country for good,” Trump said in his speech in Indiana.

“We want tax reform that is pro-growth, pro-jobs, pro-worker, pro-family, and, tax reform that is pro-American. It’s time to take care of our people, to rebuild our nation, and to fight for our great American workers,” he said.

Indiana is the home state of Vice President Mike pence. Observing that for several months, his administration has been working closely with Congress to develop a framework for tax reform, Trump said over the next few months, the House and Senate will build on this framework and produce legislation that will deliver more jobs, higher pay, and lower taxes for middle-class families, and for businesses of all sizes.

Ruing that the total business US tax rate is 60% higher than its average foreign competitors in the developed world, Trump said by doing so the US has surrendered its competitive edge to other countries.

“But we’re not surrendering anymore. We’re not surrendering anymore. Under our framework, we will dramatically cut the business tax rate so that American companies and American workers can beat our foreign competitors and start winning again,” he said.

“We will reduce the corporate tax rate to no higher than 20%. That’s way down from 35 and 39 which is substantially below the average of other industrialised nations.”

“This is a revolutionary change, and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labour, and as wages start going up at levels that you haven’t seen in many years,” he said.

Trump said corporations have parked many trillions of dollars in foreign countries, and many have incorporated abroad in order to avoid the punitive tax system altogether.

“And some companies actually leave our country because they have so much money overseas — so much, it’s an incredible amount — that they move the company to get their money. We’re going to let them bring the money back home,” he said.

The new framework will stop punishing companies for keeping their headquarters in the United States.

“We’re punishing companies under our codes for being in the United States. We will impose a one-time low tax on returning money that is already offshore so that it can be brought back home to America where it belongs and where it can be put to work and work and work,” he said.

These reforms, he said, will be a dramatic change from a failed tax system that encourages American businesses to ship jobs to foreign countries that have much lower tax rates.

“It’s what we can’t do. Our competitors have much lower tax rates. But no longer. My administration strongly rejects this off shoring model, and we have embraced the new model. It’s called the American model,” he said.

“Today, we move one step closer to fixing our broken tax code so that it puts Americans first. This is our best opportunity in a generation to deliver real middle-class tax relief, create jobs here at home, and fuel unprecedented economic growth,” said House Speaker Paul Ryan.

Top Comments

Disclaimer & comment rules-

Read all commentsCan this balance the budget?

Oct 01st, 2017 - 11:16 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!