MercoPress. South Atlantic News Agency

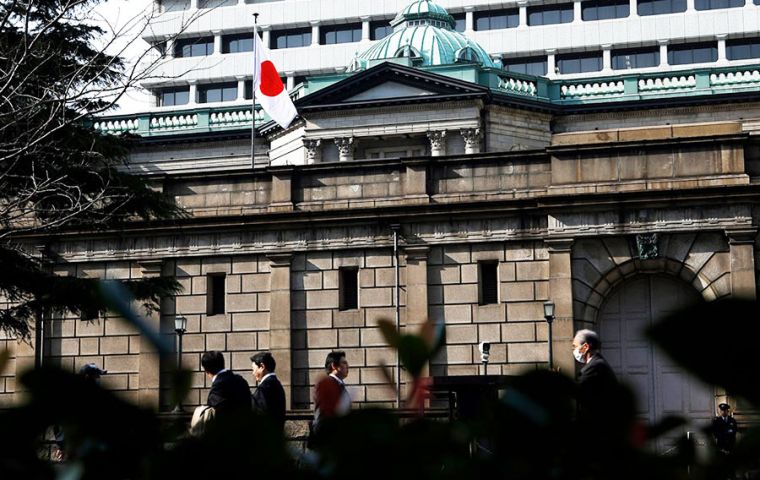

Japan's central bank owns more assets than the country's whole economy

The 553.6 trillion yen (US$ 4.87 trillion) of yen assets the Bank of Japan holds are worth more than five times the world's most valuable company Apple Inc.

The 553.6 trillion yen (US$ 4.87 trillion) of yen assets the Bank of Japan holds are worth more than five times the world's most valuable company Apple Inc. Japan's central bank has become the first among Group of Seven nations to own assets collectively worth more than the country's entire economy, following a half-decade spending spree designed to accelerate weak price growth.

The 553.6 trillion yen (US$ 4.87 trillion) of yen assets the Bank of Japan holds are worth more than five times the world's most valuable company Apple Inc. and 25 times the market capitalization of Japan's most valuable company Toyota Motor Corp.

They're also bigger than the combined GDPs of five emerging markets--Turkey, Argentina, South Africa, India and Indonesia. Central bank data released on Tuesday showed how much the BOJ has amassed over five and a half years of what it calls “quantitative and qualitative” easing policy.

The BOJ has become the world's second central bank after the Swiss National Bank and the first among G-7 countries to own a pool of assets bigger than the economy it is trying to stimulate.

Japan's nominal gross domestic product for the April-June, the latest data available, was an annualized 552.8207 trillion yen. The reading for July-September, due on Wednesday, is expected to show a contraction after natural disasters.

While some analysts credit its unique policies with lifting the economy out of decades of deflationary pressures, the BOJ has had little success meeting its 2% inflation target or reviving domestic demand and growth.

Some investors see the BOJ's inflation target as too ambitious and one that has forced it to keep buying a massive amount of bonds and stocks even as other major central banks have started to remove crisis-era policy accommodation.

At the same time, the aggressive asset purchases in recent years now mean the BOJ owns about 45% of the one quadrillion yen Japanese government bond (JGB) market, crowding out banks and other investors.

“The Bank of Japan's policy is clearly not sustainable. The BOJ would suffer losses if it would have to raise interest rates to, say, two percent,” said Hidenori Suezawa, a fiscal analyst at SMBC Nikko Securities. “Also, in case of emergencies, such as a natural disaster or a war, the BOJ won't be able to finance government bonds any longer.”

The BOJ's assets started ballooning when Governor Haruhiko Kuroda took the helm at the central bank in early 2013, vowing that such steps would boost Japan's inflation to two percent in two years. But that inflation target has proved elusive, barring a brief spike in prices after a sales tax hike in 2014.

Since Kuroda started the massive stimulus in early 2013, nominal GDP has grown a total of 11%, or a quarterly average of 0.50%, one of the fastest growth rates in recent history.

Kuroda's predecessor Masaaki Shirakawa saw the economy shrink 6%, or a quarterly average of 0.33%, during his tenure, though the global financial crisis in 2008 and tsunami and nuclear disaster in 2001 are largely to blame.

But real growth under Kuroda looks less impressive, with a total of just 6.7% so far, or a quarterly average of 0.31%. That falls short of the growth of 8.75%, or 0.44% per quarter, under Governor Toshihiko Fukui in 2003-2008, although he enjoyed a tailwind from brisk growth in emerging markets during that period.

Many investors think Kuroda's aggressive easing is approaching a limit. The BOJ has been slowing its bond purchase, with its buying falling well short of its semi-official target to increase JGB holdings by 80 trillion yen per year.

Additionally, the impact of Kuroda's aggressive buying of stocks on valuations has been fleeting. During his first year, when the BOJ bought 1 trillion yen of shares, the Nikkei index rose about 20%.

But since the BOJ doubled its buying to 6 trillion yen per year in July 2016, Japanese shares have underperformed many other markets as well as index publisher MSCI's All Country World Index, the benchmark compiler's broadest gauge of global shares covering 47 markets.

The central bank's participation in financial markets has been controversial and heavily criticized by Japan's major market participants, who say it's sapped liquidity in secondary trading of some segments, especially the domestic government bond market.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!