MercoPress. South Atlantic News Agency

Argentine central bank “ready” to counter surprises ahead of this year's presidential election

Economic volatility is common during election years in Argentina, which has one of the highest inflation rates in the world at nearly 50% last year.

Economic volatility is common during election years in Argentina, which has one of the highest inflation rates in the world at nearly 50% last year.  Macri’s leadership, which has managed to calm markets after a tumultuous 2018, is pinning hopes on an economic revival this year to propel election hopes

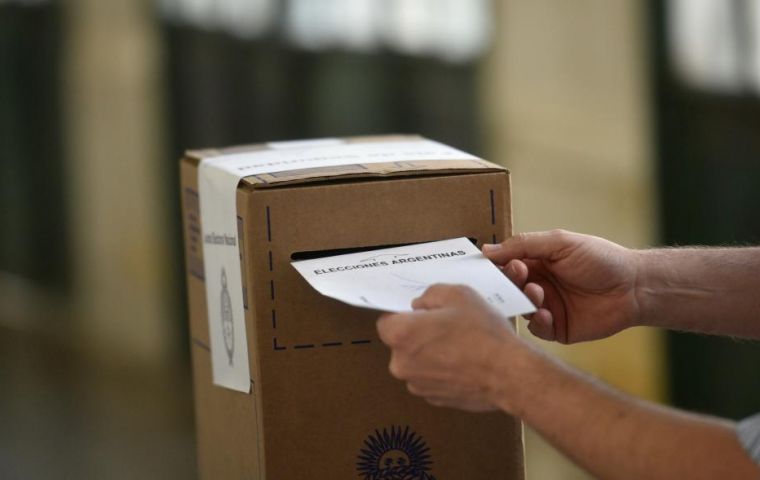

Macri’s leadership, which has managed to calm markets after a tumultuous 2018, is pinning hopes on an economic revival this year to propel election hopes Argentina’s central bank has sufficient dollar firepower to deal with a spike in demand for the greenback if uncertainty over the country’s upcoming presidential election prompts another run on the peso, bank sources said on Friday.

Investors have returned this year to pesos as the currency has stabilized after losing half its value against the dollar last year. However, there are fears this could reverse rapidly if business-friendly President Mauricio Macri fails to win a second term in October’s general election.

Economic volatility is common during election years in Argentina, which has one of the highest inflation rates in the world at nearly 50% last year.

The stakes for the country are high. Macri’s leadership, which has managed to calm markets after a tumultuous 2018, is pinning hopes on an economic revival this year to propel election hopes against the leftwing opposition. Investors fears that if the country swings back to a Peronist president, this could lead to Macri’s moves to open up the market being reversed and businesses once again looking to shift their money out of the country.

The bank source said Argentina has about US$ 14 billion at the ready to respond to potential dollar demand, including around US$ 10 billion that the finance ministry could sell during the year to pay expenses in pesos, and more than US$ 3 billion the central bank has to operate in futures.

The central bank sources emphasized that the monetary authority did not anticipate coming up short if high dollar demand were to return. “What we have to look at are the stocks in pesos that could be converted to dollars. When one looks at those stocks, it’s a quite small amount”.

The higher demand for pesos since the end of 2018 strengthened the currency by almost 1% in January. The central bank has been making daily purchases of up to US$ 50 million when the peso slips beyond the limits of a non-intervention band set as part of Argentina’s US$ 56.3 billion deal with the International Monetary Fund. The central bank has intervened by purchasing about US$ 560 million so far this year.

Top Comments

Disclaimer & comment rules-

Read all commentsThe recipe to stabilize the peso and reduce inflation is based on drying up the place of cash in circulation. The strategy is applied through a “zero fiscal deficit,” a policy imposed by the IMF (which coincidentally excludes debt service payments) and its practical effects are increased recession in most sectors of the Argentine economy.

Feb 03rd, 2019 - 06:03 am 0This is how the Macri government has “managed to calm markets after a tumultuous 2018:” By submerging the country in a deep recession.

As a result, a government incapable of showing any economic results appears to be looking for other ways to galvanize the citizens in anticipation of the October presidential election, such as encouraging a happy-trigger police, fanning the flames of xenophobia, or by -- again -- blaming the previous government for its own failures.

The story above repeats a government oft-repeated theme stating that “there are fears this could reverse rapidly if business-friendly President Mauricio Macri fails to win a second term in October’s general election.”

This is precisely part of the government's propaganda machine. Macri is anything but. Companies, small, medium-size and even large are closing down at alarming rates with the exception of those generating and delivering energy, toll highway companies, banks and financial institutions -- all fields where family members or associates are strategically placed.

But most of those in the know expect Macri government to still have some cards in the sleeve.

We'll see.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!