MercoPress. South Atlantic News Agency

Jersey, Guernsey and Isle of Man clash with Commons over financial transparency

“We have no ambiguity in our view that Westminster Parliament, cannot legislate for us on domestic matters without our consent,” argues Guernsey Deputy St Pier.

“We have no ambiguity in our view that Westminster Parliament, cannot legislate for us on domestic matters without our consent,” argues Guernsey Deputy St Pier.  The move by Labor’s Margaret Hodge Tory MP Andrew Mitchell and has been backed by more than 80 MPs, including 24 Conservatives.

The move by Labor’s Margaret Hodge Tory MP Andrew Mitchell and has been backed by more than 80 MPs, including 24 Conservatives.  The pair have already succeeded in getting UKs ÓTs s such as Bermuda, Anguilla and the Cayman Islands to establish public registers of ultimate business owners

The pair have already succeeded in getting UKs ÓTs s such as Bermuda, Anguilla and the Cayman Islands to establish public registers of ultimate business owners  Channel Islands were part of the Duchy of Normandy, so when William conquered England in 1066 Jersey and Guernsey were on the winning side at Hastings

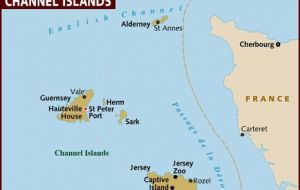

Channel Islands were part of the Duchy of Normandy, so when William conquered England in 1066 Jersey and Guernsey were on the winning side at Hastings Jersey, Guernsey and the Isle of Man are not represented in the House of Commons, yet MPs are being asked to change laws in the islands. Some have warned the move could spark a constitutional crisis, and even calls for independence. So can MPs actually force the laws - making company ownership information public - on the Crown dependencies?

Ask Guernsey's chief minister and the answer is emphatically “no”. Gavin St Pier has led efforts to convince MPs not to back an amendment to the Financial Services Bill, forcing greater transparency on the islands' financial services sectors.

“We have no ambiguity in our view that the UK - that the Westminster Parliament - cannot legislate for us on domestic matters without our consent,” Deputy St Pier says.

The move by Tory MP Andrew Mitchell and Labor's Margaret Hodge has been backed by more than 80 MPs, including 24 Conservatives. The pair has already succeeded in getting Britain's overseas territories such as Bermuda, Anguilla and the Cayman Islands to establish public registers of ultimate business owners

Now, they have gathered cross-party support in calling for the UK's tax havens closer to home to follow suit - demanding Jersey, Guernsey, and the Isle of Man also have registers in place by the end of 2020.

They argue greater transparency over company ownership is an important tool in tackling money laundering, tax avoidance and tax evasion.

MPs are yet to vote on their amendment, after the government pulled the debate and votes on the Financial Services Bill, underlining the weakness of its position in the Commons. Since then the campaigning MPs have set out their argument for forcing the law change in a strong worded-letter to island ministers

In it, they cite a 1973 report which suggested Parliament could intervene to ensure good government in the islands. The MPs also suggested money laundering in the islands threatened Britain's national security and therefore the UK was compelled to act.

The Channel Islands were part of the Duchy of Normandy, so when its leader William conquered England in 1066 Jersey and Guernsey were technically on the winning side at the Battle of Hastings.

In 1204, when King John lost Normandy to the French, the islands decided to remain loyal to the English Crown, and in return were allowed to continue to be governed by their own laws.

That agreement has been affirmed in the centuries since, with both Jersey and Guernsey developing their own democratically-elected parliaments, but with their laws effectively rubberstamped by the Queen, as head of state.

The islands therefore have a different relationship with the UK to its former colonies and overseas territories, such as Gibraltar.

The Isle of Man's parliament, the Tynwald, is one of the oldest parliaments in the world. It too was granted full autonomy, and since 1866 has steadily advanced to full democracy.

The dependencies are not directly represented by MPs, but the British government is responsible for the defence and international relations of the islands. It is the Crown, however, acting through the Privy Council that is ultimately responsible for good government.

The argument for intervention. Despite the islands' history of autonomy, Jolyon Maugham QC, a barrister who has advised both the Labour Party and Conservative government, says the UK does have the right to intervene.

“If you approach it as a lawyer, I don't think there is any real doubt that the United Kingdom can, if it wants to, legislate for the Crown dependencies without their consent,” he says.

Mr Maugham describes the relationship as one shaped by parliament, citing the recent Supreme Court ruling on Article 50, which said there was no legally-binding obligation on London to consult the devolved administrations before passing laws which affect them.

“What the Supreme Court said was 'well there might be a convention, but it's not something we can control. If government decides it wants to ignore the convention, it can ignore the convention'. And that is undoubtedly true,” he says.

Mr Maugham also sits on the advisory board of Tax Justice UK, and believes tax havens damage the functioning of what he describes as “proper” countries - economies not dependent on undermining the tax bases of others.

The campaigning MPs' transparency efforts should not come as a surprise to the island governments, he adds, pointing to efforts led by former Prime Minister David Cameron to introduce public registers in 2015.

The argument against intervention. The argument for intervening by MPs hinges, in part, on the 1973 Kilbrandon report which states the UK can only legislate without consent to ensure good government.

The low-tax dependencies argue their systems for combating money laundering so represent good government, despite accusations of not doing enough to combat financial crime.

Such an intervention by MPs citing Kilbrandon would be “controversial” and open to challenge, Guernsey lawyer Gordon Dawes says.

“It seems to me that we are well within the scope of what a responsible, autonomous government can and should do, in terms of keeping track of beneficial ownership of companies, and making that information available to other agencies.

”To me that is unarguable,“ Mr Dawes adds. Others have also argued the relationship between the islands and the UK has evolved in the 40 years since Kilbrandon was published, while Guernsey's government has pointed to a 2008 agreement it signed with the UK government It recognized the island's interests may differ from the UK's and would be a relationship of ”support not interference“

”We have no ambiguity in our view that the UK - that the Westminster Parliament - cannot legislate for us on domestic matters without our consent,” Deputy St Pier says.

The move by Tory MP Andrew Mitchell and Labor's Margaret Hodge has been backed by more than 80 MPs, including 24 Conservatives. The pair have already succeeded in getting Britain's overseas territories such as Bermuda, Anguilla and the Cayman Islands to establish public registers of ultimate business owners

Now, they have gathered cross-party support in calling for the UK's tax havens closer to home to follow suit - demanding Jersey, Guernsey, and the Isle of Man also have registers in place by the end of 2020.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!