MercoPress. South Atlantic News Agency

Markets sharply lower as Trump says he's “not ready for a trade deal with China”

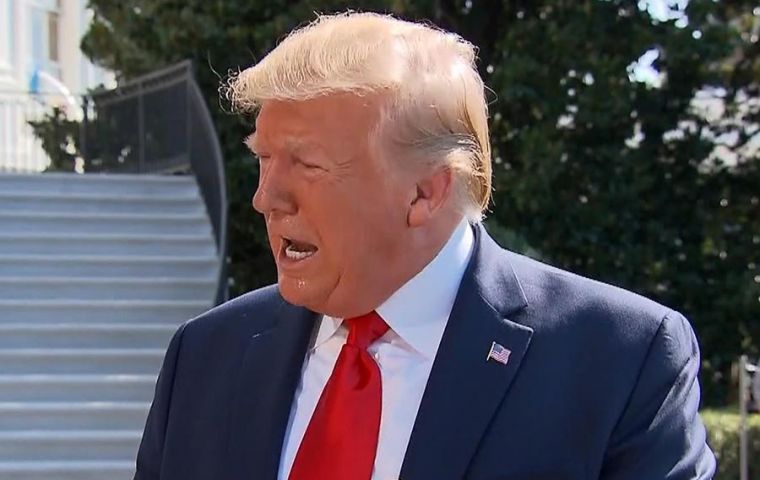

“We'll see whether or not we keep our meeting in September,” Trump told reporters at the White House before heading out for fundraisers in New York

“We'll see whether or not we keep our meeting in September,” Trump told reporters at the White House before heading out for fundraisers in New York President Donald Trump cast more doubt on chances for a trade deal with Beijing on Friday, signalling he might cancel talks set for September amid an intensifying US-China trade war.

“We'll see whether or not we keep our meeting in September,” Trump told reporters at the White House before heading out for fundraisers in New York and then vacation at his New Jersey golf resort.

Relations have soured further in the past week after Trump announced a new round of punitive tariffs on Chinese goods, despite a truce agreed with President Xi Jinping in May, and Beijing responded by halting all purchases of US agricultural goods.

The US Treasury then declared China a currency manipulator, after the Yuan lost value in the face of the new round of tariffs due to take effect Sep 1.

“We're not ready to make a deal but we'll see what happens,” Trump said. “We have all the cards. We're doing well.”

US and Chinese negotiators met in Shanghai in late July for the first time since talks collapsed in May, and were due to hold another round in September.

“Whether or not they're cancelled, we'll see,” Trump said. He added the US will not do business with Chinese tech titan Huawei, despite earlier pledges to allow American firms to file for waivers from national security restrictions on the company's operations.

His comments sent US stocks sharply lower, losing as much as 250 points, undercutting a recent recovery from the continued concerns the trade war will cause a slowdown in the global economy. Shares recovered somewhat but still closed in the red.

The countries have imposed tariffs on US$360 billion in two-way trade, and with the new round announced by Trump all Chinese goods would be subject to punishing duties.

Beijing on Monday allowed the Yuan to sink below seven to the dollar - a key psychological threshold - but then intervened to halt the decline.

Trump again accused the country of “depressing their currency,” but his comments on the trade talks sent the exchange rate even lower.

In a series of tweets on Thursday, Trump lamented the strength of the US dollar which puts US manufacturers at a disadvantage, and once again demanded the Federal Reserve lower interest rates to counteract that.

He pressed his relentless campaign against the US central bank on Friday, but backed away from calls for a weaker exchange rate for the dollar.

“No I wouldn't do that,” Trump said when asked if he wanted to devalue the dollar.

However, “If the Federal Reserve would bring down interest rates over a period of time, I would love to see a point or a little more than that.”

The Fed raised the benchmark US interest rate four times last year, a total of a full percentage point, but pulled back with a rate cut last week.

Lowering the benchmark lending rate tends to reduce demand for the dollar, thereby weakening its value, but the US economy remains stronger than those of many of its trading partners and investors flock to the dollar when there is economic uncertainty.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!