MercoPress. South Atlantic News Agency

Argentina expected to make a symbolic US$ 225 million interest payment

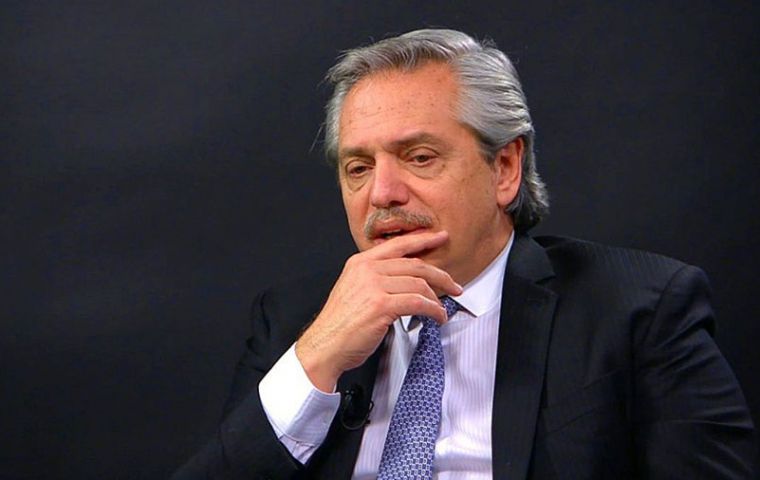

President Alberto Fernandez had initially set the end of March as a deadline for reaching a deal with bondholders but has faced delays in the process, many due to the coronavirus pandemic

President Alberto Fernandez had initially set the end of March as a deadline for reaching a deal with bondholders but has faced delays in the process, many due to the coronavirus pandemic Argentina will layout “guideposts” this week for a restructuring of its nearly US$70 billion in foreign debt, but the country is not yet ready to make a formal proposal to creditors, according to political sources in Buenos Aires.

The government of president Alberto Fernandez had initially set the end of March as a deadline for reaching a deal with bondholders but has faced delays in the process, many due to the coronavirus pandemic that has hammered global economies and shut down borders.

Argentina is facing a race to revamp its debts with private creditors and major backers including the International Monetary Fund and stave off a default, which could cut off its access to global markets even as it battles recession and inflation.

Allegedly despite the situation, Argentina intends to make a US$ 225 million interest payment due on Tuesday while trying to keep creditors at ease.

The action lines to be unveiled early this week, will add detail to the macroeconomic roadmap the government presented earlier this month, and supposedly give principles for a “sustainable” debt restructuring “without it laying out an offer.”

Sustainable is a crucial word in the talks since it was the IMF that described the Argentine debt as “non sustainable”, meaning private bondholders will have to accept some haircut or extension in time of the credits Argentina must reimburse.

Argentina had initially intended to launch an offer for creditors by mid-March and strike a deal by the month’s end. It has been hurt the pandemic, however, which has seen it forced to cancel road-shows and hold digital meetings with creditors.

Argentina’s Economy Minister Martin Guzman has said that under realistic fiscal and growth forecasts Argentina cannot service its current debt loads and needs substantial relief from its global creditors. Guzmán informed the Argentine congress that it will be at least until 2023, when sufficient surplus will be generated to face debt payments.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!