MercoPress. South Atlantic News Agency

Ecuador receives temporary reprieve to defer interest payments

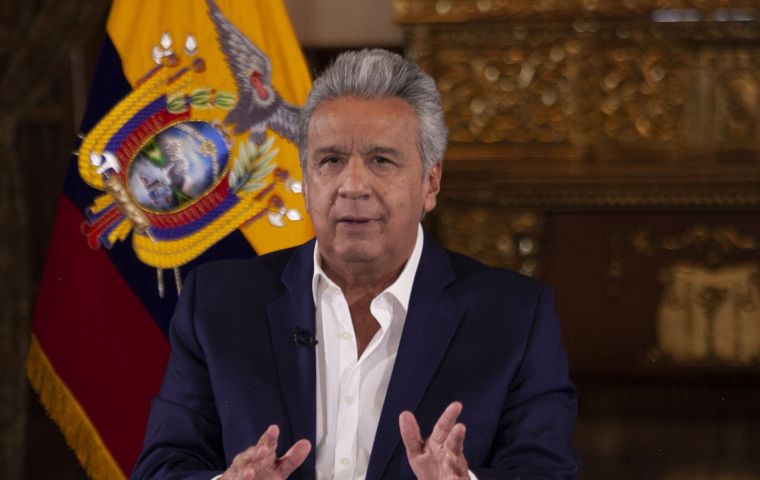

President Lenin Moreno administration has been seen taking the right actions but has been hit by the pandemic and plummeting crude prices

President Lenin Moreno administration has been seen taking the right actions but has been hit by the pandemic and plummeting crude prices Ecuador received a temporary reprieve over the weekend when the government announced that a sufficient number of investors had agreed to a consent solicitation to defer interest payments.

The consent targeting some US$19bn of dollar bonds was launched earlier this month as the embattled sovereign sought some short-term debt relief and time to address its shaky public finances.

The sovereign had asked bondholders to defer interest due between March 27 and July 15 until August, and reduce interest due after March 27 by US$0.50 on each US$1,000 of principal.

Over that period it also wants to exclude cross-default clauses on certain debt instruments, including social bonds issued earlier this year and sovereign-guaranteed 2020 bonds issued by Petroamazonas.

The administration of President Lenin Moreno has been seen taking the right actions but has been hit by a series of recent events - namely the COVID-19 pandemic and plummeting crude prices - that have further hurt the finances of the cash-strapped oil exporter.

“Debt holders trust in Ecuador,” the country's president Lenin Moreno tweeted.

“They have accepted to renegotiate [the debt]. We have just saved US$811m that will serve to help in the national emergency that the country is going through.”

Investors holding some 91.52% of outstanding principal amount on over US$17bn of bonds agreed to the consent, while 82.24% of the holders of the 7.95% 2024s came on board.

The buy side had been expected to agree to Ecuador's request in the hope that giving the government some breathing space would help it avoid a hard default and messier restructuring talks going forward.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!