MercoPress. South Atlantic News Agency

Dollar strapped Argentina does not discard further financial support from IMF

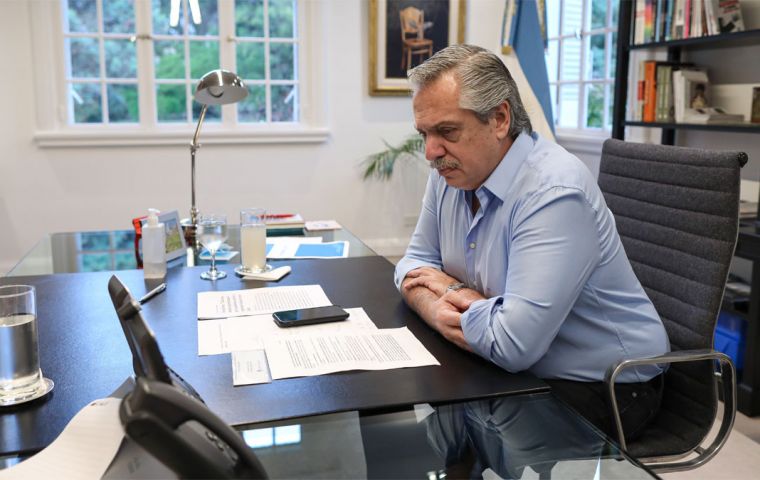

The president Alberto Fernandez government has been unable to contain the loss of international reserves, given the historic mistrust of Argentines of their currency

The president Alberto Fernandez government has been unable to contain the loss of international reserves, given the historic mistrust of Argentines of their currency  “The position of the Argentine government has always been to keep the option open and refinance what is needed to be reimbursed”, Chodos revealed

“The position of the Argentine government has always been to keep the option open and refinance what is needed to be reimbursed”, Chodos revealed The Argentine representative before the International Monetary Fund, IMF, Sergio Chodos, admitted that it could be necessary for further financing from the IMF, with which Argentina is in the process of renegotiating conditions for the return of the US$ 44 billion loaned to the previous government of ex-president Mauricio Macri.

“The position of the Argentine government has always been to keep the option open and refinance what is needed to be reimbursed; that is the intention”, Chodos said interviewed by an Uruguayan radio station.

“It is true that we might have needs a bit above the rod, which could very well happen, but I imagine it won't be an exorbitant sum compared to the previous loan. The idea is to gradually walk out, and not have to return”, Chodos added when asked if the option meant including fresh funds or simply negotiating the current debt..

Despite all kinds of efforts and procedures the government of president Alberto Fernandez has been unable so far to contain the loss of international reserves, given the historic mistrust of Argentines of their currency, and expectations created by the fact that the gap between the official exchange rate and the blue (marginal) dollar is 125%.

The Argentine government goal is that a new deal could help pay for the maturities of the agreement signed by ex president Macri, originally a massive loan of US$ 57 billion, but the Fernandez administration after rejecting the latest leg of the loan anyway has ahead a debt with the IMF of US$ 44bn.

Private analysts in Argentina estimate that the Central Bank reserves are in a minimum danger zone and insist new funds are needed to recover the creditability, and leeway for the bank in dealing with the market.

“It is absolutely necessary that the new agreement with the IMF can be reached before next July, and even more convenient that it should be ready by April, March 2021”, underlined the Argentine representative before the IMF. This is because Argentina must begin in the next few months payments to the IMF and to the Paris Club debt renegotiation.

“If we advance with the sufficient speed and have a program that takes into account the needs of Argentina, I believe it could be reached before”, admitted Chodos.

IMF negotiations, following on recent exploratory talks in Buenos Aires, are expected to officially begin in the second week of next month; it then has to be approved by the IMF Executive Board, and obviously the necessary political consensus in Argentina, a most challenging hurdle given the “good name” of the multilateral body in the country.

”We have clearly stated that any deal (with IMF) must have the approval of the Argentine congress”, pointed out Chodos.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!