MercoPress. South Atlantic News Agency

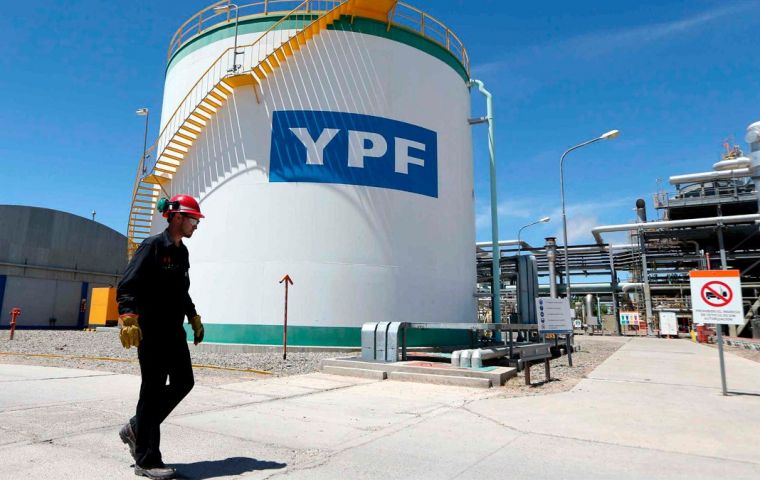

YPF closer to restructuring its debt, expecting to concentrate in boosting shale deposits in Patagonia

Support from the group increases YPF’s chances of avoiding a hard default next month

Support from the group increases YPF’s chances of avoiding a hard default next month Argentina’s state-managed oil giant expects to avoid a costly default next month after it won support for a debt swap from a large creditor group. The so-called Ad Hoc Bondholder Group, which holds 45% of YPF’s 2021 notes, expressed support for the exchange after the company increased its cash sweetener over the weekend.

Bonds due in 2021 rose 4.5 cents to 95 cents on the dollar, in New York, the highest since Jan. 8. The company’s shares climbed as much as 7%. YPF amended its debt proposal for a fourth time, offering creditors US$ 408 dollars in cash for every US$ 1,000 of 2021 bonds tendered in the exchange. Previously, YPF was offering its creditors a US$ 283 cash payment.

The latest offer “represents an improvement,” and “provides a balanced solution for the 2021 notes,” the group said in the statement. The new deadline to take the deal is Feb. 10 at 11:59 p.m. in New York.

Support from the group increases YPF’s chances of avoiding a hard default next month, according to Santiago Barros Moss, an analyst at TPCG Valores in Buenos Aires. Moss wrote in a note to clients. “We believe that the participation of the Ad Hoc group will encourage other holders to participate in the exchange.”

The company needs agreement from more than 50% of holders of the 2021 notes maturing in March in order to exchange them, and already has support from another creditor group which holds 25% of all of YPF’s bonds.

YPF surprised creditors in January by announcing a plan to restructure US$ 6.2 billion of debt after the central bank denied it access to the dollars it needs to make the March payment. YPF and its creditors have been in talks since then.

Last week, the Ad Hoc group of creditors led by Clifford Chance rejected a February first offer. The second group, led by law firms Dechert LLP and DLA Piper, said it supported the company’s proposal.

Cash-strapped YPF’s debt restructuring plans are designed to free up money to boost production in the shale-rich region of Vaca Muerta in Patagonia. YPF has been hard hit by the coronavirus pandemic and depressed demand.

YPF, which faces a US$ 413 million payment in March on the 2021 bond, needs to swap some 60% of the total bonds in order to get dollars from the central bank, which has toughened rules to protect declining international reserves.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!