MercoPress. South Atlantic News Agency

Economy

-

Tuesday, January 6th 2009 - 20:00 UTC

Uruguay 2008 exports grow 31% in value, reach 6 billion USD

Uruguay exports grew by 31.3% in value in 2008, its biggest increase in the last four years, despite the negative effects that the international financial crisis had on the country in the last two months of the year, according to an official report.

-

Tuesday, January 6th 2009 - 20:00 UTC

Chile massive stimulus plan has full political support

Chile announced a stimulus plan increasing spending by four billion US dollars in an effort to create jobs and prop the economy. This means that for the first time in six years Chile will run a budget deficit, 2.9% of GDP.

-

Tuesday, January 6th 2009 - 20:00 UTC

Chavez promises low oil prices will not stop the revolution

Venezuelan President Hugo Chavez forecasted that the “unity” of the world's big producers of crude will restore stability to global petroleum markets and anticipated that even if the price of Venezuelan oil falls to zero, “the Bolivarian revolution will continue”.

-

Tuesday, January 6th 2009 - 20:00 UTC

Five Brazilian banks concentrate 65% of financial assets

The share of total assets held by Brazil's five largest banks rose to 65.72% at the close of 2008, up more than 13 percentage points from the end of the previous year, according to Central bank figures quoted by financial and business daily Valor.

-

Tuesday, January 6th 2009 - 20:00 UTC

Britain's house prices fell a record 15.9% during 2008

Britain's biggest building society has said house prices fell by a record 15.9% during 2008 as it warned the property market was in for another turbulent year. Nationwide said prices were likely to have further to fall before significant numbers of buyers returned to the market, although it stopped short of making a specific forecast for price drops in 2009.

-

Tuesday, January 6th 2009 - 20:00 UTC

Forest fire smoke plumes slow tourist traffic in Uruguay

A forest fire that was preventing tourists from reaching Uruguay's sea resorts, including the upscale vacation spot of Punta del Este has been brought under control, although fire-fighters and the military were still working to extinguish the blaze completely, officials said.

-

Tuesday, January 6th 2009 - 20:00 UTC

Rich Latin-Americans, leading banks caught in Madoff's net

Wealthy Latin Americans are among the biggest victims of an alleged 50 billion US dollars Ponzi scheme orchestrated by financier Bernard Madoff, The Wall Street Journal reported on Monday.

-

Tuesday, January 6th 2009 - 20:00 UTC

Wall Street Ratings agencies threatened? Standards too Poor?

Ratings companies used to have a great name. No longer. The subprime mortgage crisis has seen to that. Once seen as being blue chip companies with a sterling reputation, the ratings companies have now come to be seen as part of the sordid network of double dealing in Wall Street in which conflicts of interest and outright dishonesty led to millions losing money, while the fat cats of the ratings companies raked it all in.

-

Monday, January 5th 2009 - 20:00 UTC

South Korea and Japan reopen markets to Chilean pork

South Korea and Japan reopened their markets to Chilean pork, according to a release in Seoul from the Ministry of Agriculture and Food.

-

Monday, January 5th 2009 - 20:00 UTC

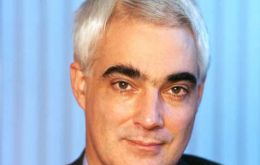

IMF considers UK Chancellor Darling's forecast “optimistic”

Britain's Chancellor of the Exchequer prediction on when the UK economy could start to recover may be “optimistic”, a director of the International Monetary Fund has said.