MercoPress. South Atlantic News Agency

International

-

Monday, July 12th 2010 - 03:48 UTC

Chinese trade “has recovered to pre-crisis levels” affirms Beijing

China’s trade surplus widened to the highest this year and exports climbed more than estimated to a record in June, adding pressure on the government to let the currency gain after the U.S. said the Yuan “remains undervalued.”

-

Monday, July 12th 2010 - 03:41 UTC

Record import of soy beans by China during June

Soy-bean imports by China, the biggest buyer, jumped to a record in June after a halt to Argentine soy oil shipments and increasing feed consumption boosted demand from crushers, according to Bloomberg.

-

Monday, July 12th 2010 - 03:04 UTC

Mrs. Kirchner in China to try and reopen the soy-oil market

Argentine president Cristina Fernández de Kirchner arrived Sunday in Beijing with a delegation of 70 businessmen and an agenda concentrated on trade issues including one which is fundamental for Argentina, the resumption of soy-oil sales to China which have been banned for several months.

-

Monday, July 12th 2010 - 02:48 UTC

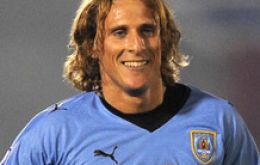

Uruguay’s Diego Forlan, South Africa World’s Cup top individual player

Diego Forlan thumped his right boot against the advertising hoarding in Suwon. The 23-year-old striker's frustration was understandable. He had just spurned a glorious chance to score for Uruguay against Senegal. It was ultimately one that cost his country a 4-3 victory and a place in the Round of 16 of the 2002 FIFA World Cup Korea/Japan.

-

Saturday, July 10th 2010 - 07:57 UTC

Brazil launches logo, song and campaign to promote 2014 World Cup

Brazilian President Lula launched “Brazil is Calling You” campaign in Johannesburg, following South Africa officially handing over the keys to Brazil as the next host nation of the FIFA World Cup.

-

Saturday, July 10th 2010 - 07:53 UTC

African party backfires for Lula da Silva who anticipates return to Brazil

Brazilian president Lula da Silva confirmed Friday he will not be present at the South Africa World Cup final on Sunday because he has urgent work in the northeast of the country ravaged by floods that has left tens dead and thousands homeless.

-

Friday, July 9th 2010 - 05:34 UTC

Euro zone rates unchanged; all eyes set on 23 July EU banks’ stress-tests

The European Central Bank left its key interest rate on hold for the fourteenth consecutive month in July as the region's banks face stress tests to ensure the stability of the financial system that is threatened by investor fears about debt.

-

Friday, July 9th 2010 - 05:29 UTC

UK leaves rates at a record low for the 16th month running

The Bank of England has kept UK interest rates on hold at a record low of 0.5% for the 16th consecutive month. The Bank's Monetary Policy Committee (MPC) also decided on Thursday not to inject any more money into the economy under its policy of quantitative easing (QE).

-

Friday, July 9th 2010 - 04:45 UTC

China confirms it will stick to moderately loose monetary policy

China’s central bank said on Thursday it will stick to a moderately loose monetary policy as economic growth becomes better balanced between consumption, investment and exports.

-

Friday, July 9th 2010 - 01:58 UTC

UK and Irish farmers’ claim Brazil’s beef exports fail to meet EU standards

The UK National Farmers Union, NFU and Irish Farmers' Association have expressed concern about the reopening trade talks with the Mercosur group of South American countries because of the impact it could have on farmers.