MercoPress. South Atlantic News Agency

Investments

-

Wednesday, April 7th 2010 - 01:09 UTC

Falklands’ Desire describes Liz well as “promising”; confirms drilling campaign

Following the announcement of a gas discovery in the North Falklands Basin, Desire's Chairman Stephen Phipps describes the ‘The Liz’ well as, “complex and highly encouraging” and sufficiently promising to continue with the drilling campaign in Falklands’ waters.

-

Friday, April 2nd 2010 - 00:04 UTC

Desire Petroleum plc - Drilling Update

Desire Petroleum Plc (AIM:DES) the oil and gas exploration company, wholly focused on the North Falkland Basin, wishes to provide a further drilling update on the Liz 14/19-1 Exploration well, where wireline operations are continuing.

-

Thursday, April 1st 2010 - 05:53 UTC

Falkland Islands: Investors lose fortunes as oil shares plummet

LOCAL investors – reputedly one in ten of the population – saw the value of their oil shares plummet this week as Desire Petroleum confirmed media speculation that the first oil found by the Ocean Guardian rig was of poor quality.

-

Wednesday, March 31st 2010 - 02:14 UTC

Main traders agree on quarterly contracts for iron ore, but no mention of China

Two of the world's biggest mining companies have agreed landmark deals with Asian steel mills to buy iron ore on quarterly contracts. The deals could mark the end of annual contracts that have formed the basis for pricing in the steel industry for decades.

Vale and BHP Billiton said the new system was fairer and more transparent. -

Saturday, March 20th 2010 - 01:25 UTC

China and Rio Tinto will jointly develop massive iron ore deposits in Guinea

Anglo-Australian mining company Rio Tinto announced it has signed a deal with China to develop a massive iron ore mine in West Africa. China's state-backed metals group Chinalco will pay 1.3 billion US dollars for 47% of the Simandou project in Guinea.

-

Tuesday, March 16th 2010 - 04:58 UTC

Rio Tinto/Alcan presents project for 2.5bn aluminium smelter in Paraguay

Rio Tinto Alcan, a unit of global mining giant Rio Tinto formally presented on Monday plans to invest 2.5 billion US dollars in an aluminium smelter in Paraguay, according to corporation and Asuncion sources.

-

Monday, March 15th 2010 - 11:16 UTC

Chinese oil firm buying 50% stake in Argentine group

China National Offshore Oil Corporation (CNOOC) is paying $3.1bn (£2bn) for a 50% stake in Argentine oil and gas group Bridas Corporation. Cnooc Ltd.,

-

Friday, March 12th 2010 - 00:59 UTC

BP gets a hold of Brazil’s oil potential buying out US Devon Energy

British Petroleum has agreed to buy Brazilian, Azeri and Gulf of Mexico assets from Devon Energy for 7 billion US dollars, as the US producer refocuses on onshore US fields.

-

Tuesday, March 9th 2010 - 22:33 UTC

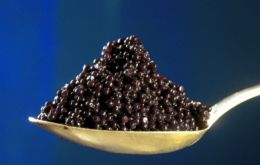

Russian company sets up sturgeon farm in Argentina to produce caviar

The Russian company Sturgeon & Caviar is set to begin in coming weeks the production of caviar in the Argentine northern province of La Rioja according to local government sources.

-

Friday, February 19th 2010 - 00:17 UTC

China investing heavily in long term supply resources projects in Latinamerica

China’s voracious appetite for Latinamerican commodities is turning into a great opportunity for companies in the region not only because of the huge market but also as a great financial source.