MercoPress. South Atlantic News Agency

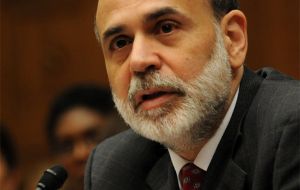

Bernanke reaffirms Fed’s independence to ensure public confidence and stability

Fed chairman: institutional independence means transparency and accountability

Fed chairman: institutional independence means transparency and accountability “The US Federal Reserve has been granted, both in law and in political tradition, considerable independence and autonomy. That independence serves important public objectives. Critically, it allows the Federal Open Market Committee to make monetary policy in the longer-term economic interests of the American people, rather than in the service of short-term political imperatives”.

The statement belongs to Ben S. Bernanke who was formally sworn in this week for a second four-year term as Chairman of the Board of Governors of the Federal Reserve System (US central bank).

In a brief speech Bernanke made a quick review of the past four years: the achievements, the errors, the challenges and above all in the interest of maintaining public confidence and promoting economic and financial stability, “we must continue to protect our independence”.

With this purpose the Fed should also be prepared to become “even more transparent” said the Fed chairman insisting that “it is essential that the public have the information it needs to understand and be assured of the integrity of all our operations, including all aspects of our balance sheet and our financial controls”.

For this chairman Bernanke promised to continue working with Congress to ensure maximum transparency.

Bernanke said that Federal Reserve in the last two years faced the deepest financial crisis since the Great Depression and helped prevent a looming economic collapse, but also “too many people remain unemployed, foreclosures continue at record rates, and bank credit continues to contract”.

He also admitted that “the crisis revealed weaknesses and gaps in the regulation and supervision of financial institutions and financial markets”.

The full speech of the chairman Bernanke follows:

“It is with considerable gratitude and not a little humility that I begin a second term as Chairman of the Board of Governors. I thank President Obama for the confidence he has shown in me by re-nominating me and the members of the Senate for confirming my nomination.

The past four years have been an extraordinary time. In many respects, this period has shown this institution at its finest, as we moved rapidly, forcefully, and creatively to confront the deepest financial crisis since the Great Depression and help prevent a looming economic collapse. This swift and effective response would not have been possible without the remarkable dedication, professionalism, and personal sacrifices of the Federal Reserve staff. I would like to express my deep appreciation to all of you for your creativity and hard work. America and the world owe you a debt of gratitude.

At the same time, this institution, like our country, faces enormous challenges, challenges that will demand continued commitment and professionalism from staff members in every division.

On the economic front, the resumption of growth in the nation's output of goods and services is encouraging. But far too many people remain unemployed, foreclosures continue at record rates, and bank credit continues to contract. We at the Federal Reserve cannot hope to solve all these problems on our own--other policymakers and those in the private sector must do their part--but we must continue to do all that we can to ensure that our policies are helping to guide the country's return to prosperity in an environment of price stability.

At the Federal Reserve and other agencies, the crisis revealed weaknesses and gaps in the regulation and supervision of financial institutions and financial markets. Working together, the Fed staff and the Board have made considerable progress in identifying problems and improving how we carry out our oversight responsibilities. We are restructuring our supervisory framework, for example, to incorporate a more systemic, multidisciplinary perspective. We are engaging with international colleagues to develop tough, comprehensive regulations to promote the safety and soundness of financial institutions, and we have developed and implemented strong new protections for consumers. We will continue to work with the Congress to develop an effective, comprehensive reform of financial regulation. As we move forward, we must continue to do all that can be done to ensure that our economy is never again devastated by a financial collapse.

The Federal Reserve has been granted, both in law and in political tradition, considerable independence and autonomy. That independence serves important public objectives. Critically, it allows the Federal Open Market Committee to make monetary policy in the longer-term economic interests of the American people, rather than in the service of short-term political imperatives. It also allows the Federal Reserve to make supervisory decisions based on the facts of each case and the need to preserve financial stability, not on the basis of political considerations. In the interest of maintaining public confidence and promoting economic and financial stability, we must continue to protect our independence.

At the same time, in a democratic society like our own, institutional independence brings with it fundamental obligations of transparency, responsiveness, and accountability. The Federal Reserve is already one of the most transparent and accountable central banks in the world, providing voluminous information and explanation concerning all of its activities. However, I believe that we should be prepared to do even more, to become even more transparent. It is essential that the public have the information it needs to understand and be assured of the integrity of all our operations, including all aspects of our balance sheet and our financial controls. We will continue to work with the Congress to ensure maximum transparency of America's central bank, without compromising our ability to conduct policy in the public interest.

These are just some of the challenges that we will all face in the coming months and years. I thank you for the many expressions of support I received during the confirmation process, for your hard work and dedication, and for your service to your country. I look forward to continuing to work with all of you to strengthen our economy and to make the Federal Reserve as effective as it can possibly be in advancing the economic wellbeing of all Americans. Thank you”.

Chairman Bernanke began his second term on February 1 following his confirmation by the Senate on January 28 and a hearing on December 3 by the Senate Committee on Banking, Housing and Urban Affairs.

President Obama announced his intention to nominate Chairman Bernanke on August 25. He originally took office as Chairman on February 1, 2006.

Chairman Bernanke's new term as Chairman ends January 31, 2014, and his 14-year term as a member of the Board ends on January 31, 2020.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!