MercoPress. South Atlantic News Agency

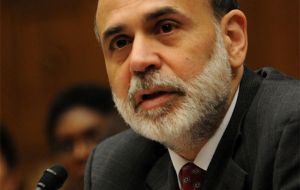

Bernanke raises concern over persistent high unemployment

US Federal Reserve chairman

US Federal Reserve chairman Lending to small businesses inn the United States is declining, thus making it more difficult to come to grips with the persistent problem of high unemployment, admitted Federal Reserve Chairman Ben Bernanke.

Bernanke said policymakers have largely succeeded over the past two years in stabilizing the US financial system and economy but the scarcity of jobs is a concern.

“I raise this issue here because healthy small businesses, including start-ups as well as going concerns, are crucial to creating jobs and improving employment security,” he told a meeting at the Chicago Fed's Detroit branch organized to discuss the financing needs of Michigan's small businesses.

Bernanke noted that loans to small businesses dropped from nearly 700 billion USD in the second quarter of 2008 to about 660 billion in the first quarter of 2010, though he conceded it was hard to tell exactly why.

“An important but difficult-to-answer question is how much of this reduction has been driven by weaker demand for loans from small businesses and how much by restricted credit availability,” Bernanke said.

He said the Fed was still examining causes for the reduced flow of credit to businesses and said it was “vital” that it stay focused on discovering why it was happening and correcting the situation.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!