MercoPress. South Atlantic News Agency

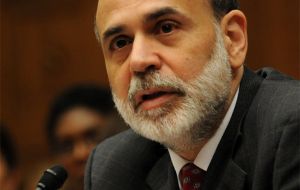

Bernanke warns US job creation too weak and calls for budget discipline

US Federal Reserve chairman says only one out of eight million jobs lost have been made up

US Federal Reserve chairman says only one out of eight million jobs lost have been made up US unemployment remains too high for policymakers' comfort despite signs of strength in the economic recovery, Federal Reserve Chairman Ben Bernanke said. In testimony to the US House of Representatives' Budget Committee that largely echoed a speech he delivered last week, Bernanke also warned about the dangers of unsustainable budget deficits.

He cited a number of encouraging hints from the labour market, including a drop in the jobless rate to 9% in January from 9.8% in November - the biggest two-month drop since 1958. At the same time, Bernanke expressed concern at the still-anaemic pace of hiring.

“The job market has improved only slowly,” he said, noting the economy had only made up just over 1 million of the more than 8 million jobs lost during the deepest recession in generations.

“This gain was barely sufficient to accommodate the inflow of recent graduates and other new entrants into the labour force and, therefore, not enough to significantly erode the wide margin of slack that remains in our labour market.”

Bernanke said inflation remains quite low in the United States, a tough message to deliver amid headlines of rising food and commodity costs across the globe.

He also said expectations of future inflation had remained “stable,” suggesting little worry a inflationary psychology was building despite rising gasoline costs.

“Inflation is expected to persist below the levels that Federal Reserve policymakers have judged to be consistent” with their mandate, Bernanke repeated.

Bernanke was sure to be peppered with questions on both Fed policy and the budget by a Republican-led Congress that has become increasingly impatient with the Fed.

Pre-emptively, the Fed chairman had much the same message that he has offered repeatedly: either legislators bring the budget under control or the markets will force them into it.

“Creditors would never be willing to lend to a government with debt, relative to national income that is rising without limit” he said. If unheeded, the adjustment could ”come as a rapid and painful response to a looming or actual fiscal crisis”.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!