MercoPress. South Atlantic News Agency

Fed admits it does not have a “precise read” of why US economy is slowing

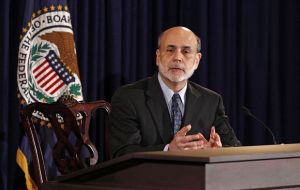

Bernanke says US economy will pick up in 2013, but unemployment will remain stubbornly high (Photo Reuters)

Bernanke says US economy will pick up in 2013, but unemployment will remain stubbornly high (Photo Reuters) The Federal Reserve has cut its growth forecast for the US economy in the face of the impact of higher energy prices. It now estimates that the US economy will expand between 2.7% and 2.9% this year, down from its April forecast of 3.1% to 3.3%.

The US central bank also warned that unemployment would remain stubbornly high throughout 2011. Chairman Ben Bernanke speaking on Wednesday after the meeting of the Fed Open Market Committee said the central bank didn't have “a precise read on why the US economy is slowing down” but notes that it expects a pick-up by 2013.

Bernanke said higher prices had hit consumer spending, but that they should start to fall. However he further cautioned that weakness in the financial sector, and the continuing slump in the housing market, could also be holding back the economy - problems he said “may be stronger and more persistent than we thought”.

Regarding higher prices, Mr Bernanke said they were likely to only be “temporary”.

“In particular, consumers' purchasing power has been damaged by higher food and energy prices,” he said. “However some moderation in gasoline prices is now a prospect”.

Bernanke also lauded the idea of a formal inflation target, which he said could help anchor expectations, but he said nothing was imminent and pointed out that the Fed would need public, Congressional and White House “buy-in” before it proceeded.

The Fed chairman said the US manufacturing sector, especially the car industry, had also been hit by supply problems due to the aftermath of the Japanese earthquake and tsunami. However, he said such supply chain disruptions were “likely to dissipate in coming months”.

Despite downgrading its growth forecast, the Federal Reserve confirmed that it would complete its 600bn US dollars bond buying program by 30 June as planned, and will maintain its existing policy of reinvesting principal payments from its securities holdings: No further measures to boost the economy was announced.

The central bank's latest economic growth estimate was released after its policy-setting Federal Open Market Committee voted unanimously to keep US interest rates on hold for the 22nd meeting in succession - as had been expected.

US interest rates have now been between 0% and 0.25% since December 2008 in an effort to boost economic growth. The Federal Reserve said rates would probably remain at this level “for an extended period”.

Regarding unemployment, the central bank said the jobless rate would probably average between 8.6% and 8.9% towards the end of the year, down from 9.1% in May.

On its inflation estimate, the Federal Reserve said the picture was little changed, and that it should average between 2.3% and 2.5% this year.

Mr Bernanke also addressed the continuing debt woes of Greece in his press conference.

With the Greek parliament now due to vote next week on the latest round of spending cuts the European Union says is necessary before it gets another vital loan, Mr Bernanke said the situation was of concern to the US.

“If there were a failure to resolve that [Greek debt] situation it would pose threats to the European financial system, the global financial system, and to European political unity,” he said. ”So yes, we did discuss it and it is one of several potential financial risks that we are facing now”. But he revealed that the US banking exposure to the Greek situation was “small”.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!